Question: Self - Study Review Problem Project Part # 2 Points The following events apply to the first year of operations for Mestro Financial Services Company:

SelfStudy Review Problem Project Part # Points

The following events apply to the first year of operations for Mestro Financial Services Company:

Acquired $ cash by issuing common stock on January Year

Purchased $ of supplies on account.

Paid $ cash in advance for a oneyear lease on office space.

Earned $ of consulting revenue on account.

$ of general operating expenses on account.

Collected $ cash from receivables.

Paid $ cash on accounts payable.

Paid a $ cash dividend to stockholders.

Information for Adjusting Entries

There were $ of supplies on hand at the end of the accounting period.

The oneyear lease on the office space was effective beginning on October Year

There were $ of accrued salaries at the end of Year

Required

a Record the preceding events in general journal format.

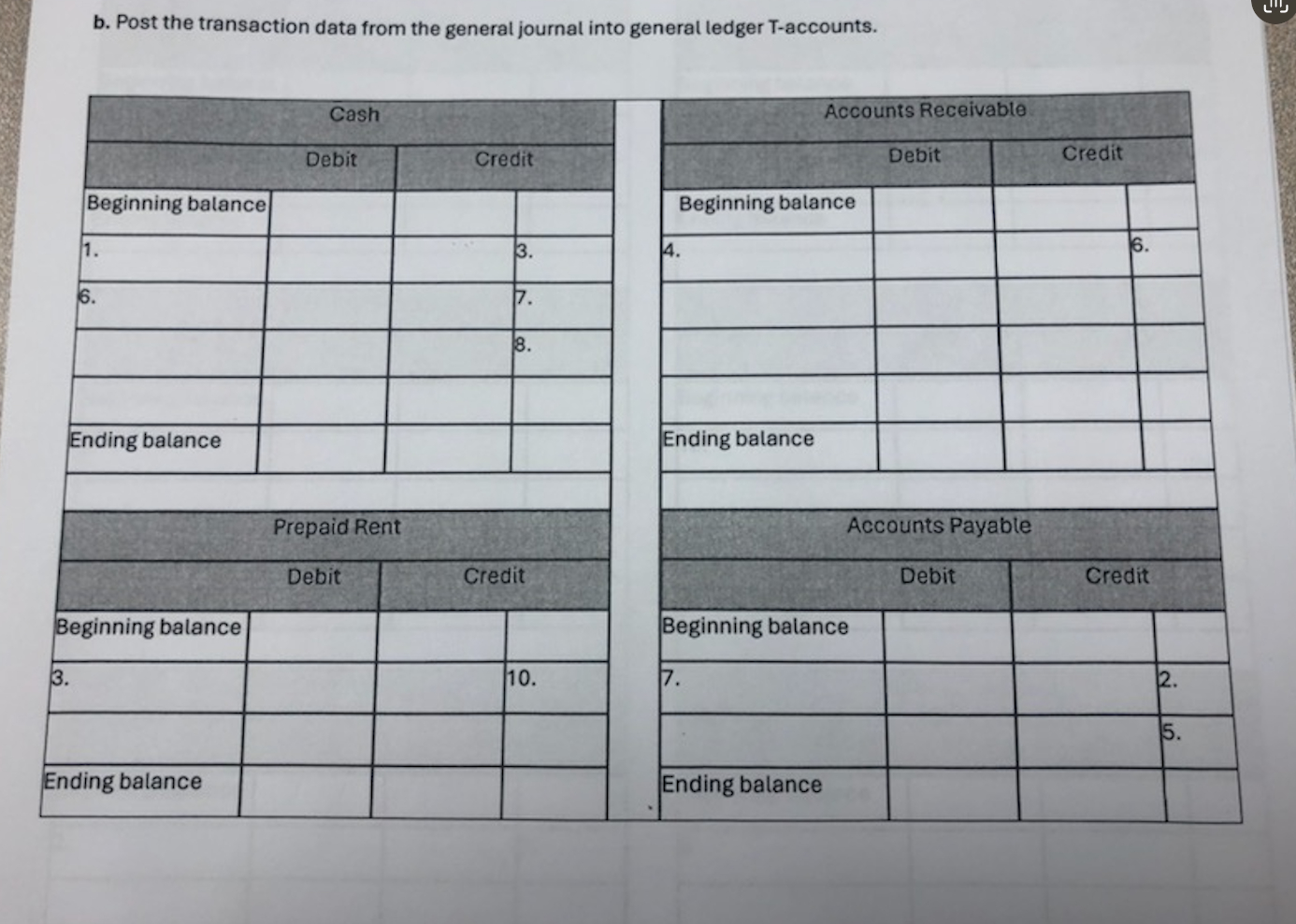

b Post the transaction data from the general journal into general ledger Taccounts.

c Prepare an adjusted trial balance.

d Prepare an income statement for Year

d Prepare a statement of changes in stockholders equity for Year

d Prepare a balance sheet for Year

d Prepare a statement of cash flows for Year

e Prepare the appropriate closing entries in general journal format.

a Record the preceding events in general journal format. b Post the transaction data from the general journal into general ledger Taccounts. Salaries Exponse

begintabularllll

hline multicolumnc Salaries Exponse

hline & Debit & multicolumnc Credit

hline Beginning batance & & &

hline & & &

hline & & &

hline & & &

hline Ending balance & & &

hline

endtabular

c Prepare an adjusted trial balance. Prepare a statement of cash flows for Year

begintabularlll

hline multicolumnc MESTRO FINANCIAL SERVICES COMPANY

hline multicolumnc Statement of Cosh Fiows

hline multicolumnc For the Year Ended December Year

hline Cash flows from operating activities: & &

hline Inflow from customers & &

hline Outflow for expenses & &

hline Net cash flow from operating activities & &

hline Cash flows from investing activities: & &

hline & &

hline Net cash flow from investing activities & &

hline Cash flows from financing activities: & &

hline Inflow from issue of common stock & &

hline Outflow for dividends & &

hline Net cash flow from financing activities & &

hline Net change in cash & &

hline Plus: Beginning cash balance & &

hline Ending cash balance & &

hline

endtabular

e Prepare the appropriate closing entries in general journal format. d Prepare an income statement for Year

d Prepare a statement of changes in stockholders' equity for Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock