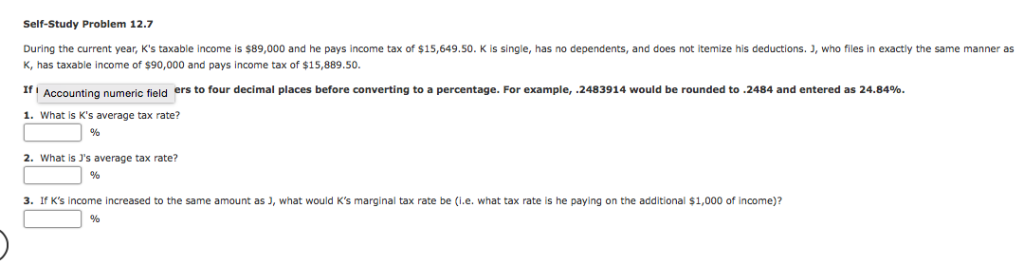

Question: Self-Study Problem 12.7 During the current year, K's taxable income is $89,000 and he pays income tax of $15,649.50. K is single, has no dependents,

Self-Study Problem 12.7 During the current year, K's taxable income is $89,000 and he pays income tax of $15,649.50. K is single, has no dependents, and does not itemize his deductions who files in exactly the same manner as K, has taxable income of $90,000 and pays income tax of $15,889.50. If Accounting numeric field ers to four decimal places before converting to a percentage. For example, 2483914 would be rounded to 2484 and entered as 24.84% 1. What is K's average tax rate? What is J's average tax rate? 3. If K's income increased to the same amount as , what would K's marginal tax rate be (Le, what tax rate is he paying on the additional $1,000 of income)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts