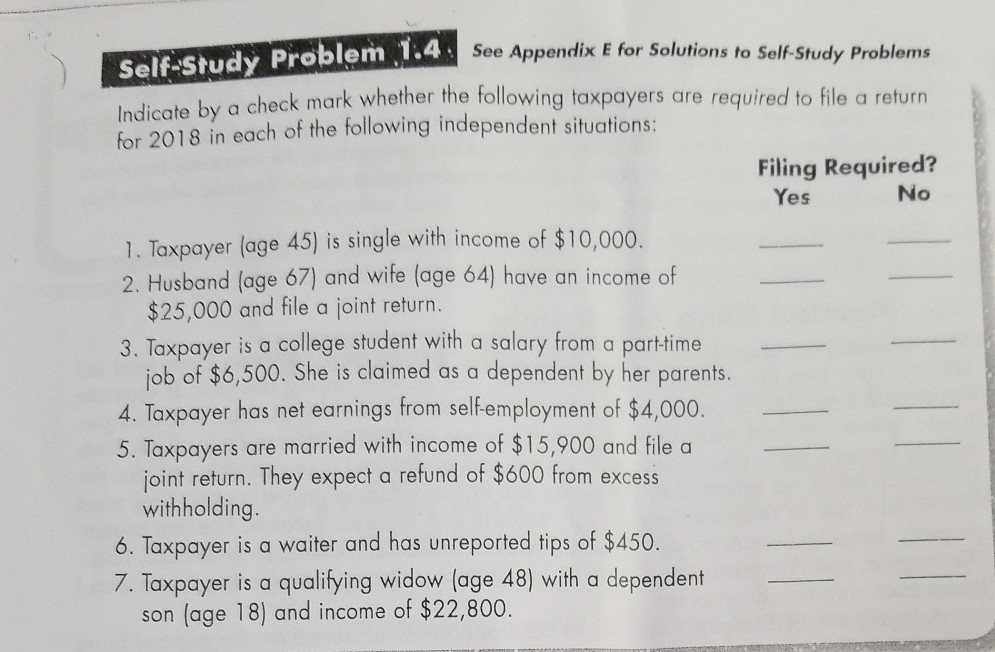

Question: Self-Study Problem 1.4 Indicate by for 2018 in each of the following independent siftuations: See Appendix E for Solutions to Self-Study Problems a check mark

Self-Study Problem 1.4 Indicate by for 2018 in each of the following independent siftuations: See Appendix E for Solutions to Self-Study Problems a check mark whether the following taxpayers are required to file a return Filing Required? Yes No 1. Taxpayer (age 45) is single with income of $10,000. 2. Husband (age 67) and wife (age 64) have an income of $25,000 and file a joint return. 3. Taxpayer is a college student with a salary from a parttime job of $6,500. She is claimed as a dependent by her parents. 4. Taxpayer has net earnings from self-employment of $4,000. 5Taxpayers are married with income of $15,900 and file a joint return. They expect a refund of $600 from excess withholding 6. Taxpayer is a waiter and has unreported tips of $450. 7. Taxpayer is a qualifying widow (age 48) with a dependent son (age 18) and income of $22,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts