Question: Self-Study Problem 2,16 For the 2022 tax year, Kim and Edward are married and file a joint return. They have Social Security benefis of $13,000

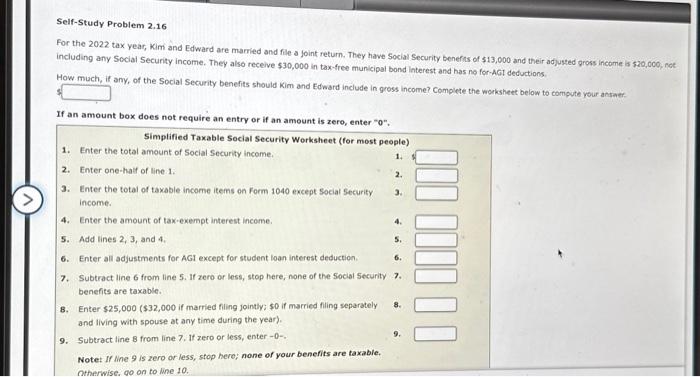

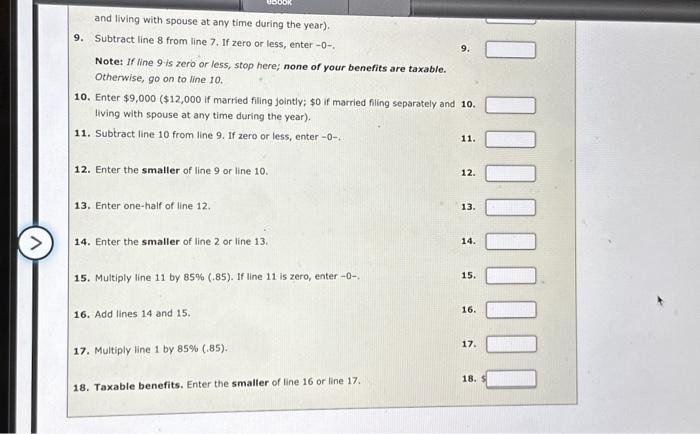

Self-Study Problem 2,16 For the 2022 tax year, Kim and Edward are married and file a joint return. They have Social Security benefis of $13,000 and their adjusted gross income is s20,000, not including any Social Security income. They also receive $30,000 in tax-free municipal bond linterest and has no for-AGt deductions. How much. if any, of the Social Security benefits should Kim and Edward include in gross income? Complete the worksheet below to compute vour ansmer. 1 If an amount box does not require an entry or if an amount is zero, enter " 0 ". and living with spouse at any time during the year). 9. Subtract line 8 from line 7 . If zero or less, enter -0 -. 9. Note: If line 9 is zero or less, stop here; none of your benefits are taxable. Otherwise, go on to line 10. 10. Enter $9,000 ( $12,000 if married filing jointly; $0 if married filing separately and 10. living with spouse at any time during the year). 11. Subtract line 10 from line 9 . If zero or less, enter -0 -. 11. 12. Enter the smaller of line 9 or line 10. 12. 13. Enter one-half of line 12. 13. 14. Enter the smaller of line 2 or line 13. 14. 15. Multiply line 11 by 85% (.85). If line 11 is zero, enter 0 - 15. 16. Add lines 14 and 15. 16. 17. Multiply line 1 by 85% (.85). 17. 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 18. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts