Question: a. Give the deductible HSA amount for each of the following taxpayers for 2021: 1. Amy is 40 years old, has a qualifying high-deductible

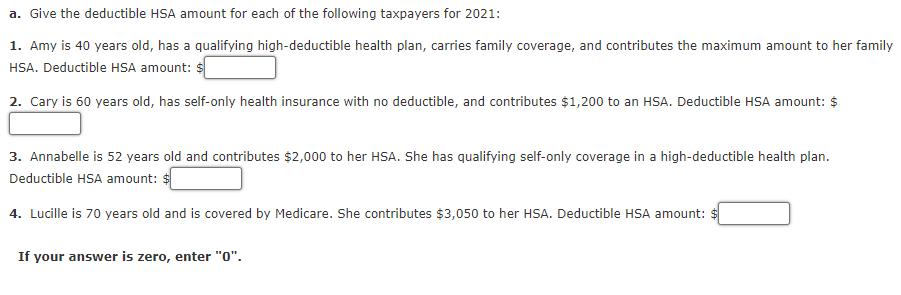

a. Give the deductible HSA amount for each of the following taxpayers for 2021: 1. Amy is 40 years old, has a qualifying high-deductible health plan, carries family coverage, and contributes the maximum amount to her family HSA. Deductible HSA amount: $ 2. Cary is 60 years old, has self-only health insurance with no deductible, and contributes $1,200 to an HSA. Deductible HSA amount: $ 3. Annabelle is 52 years old and contributes $2,000 to her HSA. She has qualifying self-only coverage in a high-deductible health plan. Deductible HSA amount: $ 4. Lucille is 70 years old and is covered by Medicare. She contributes $3,050 to her HSA. Deductible HSA amount: If your answer is zero, enter "0".

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

name age amount deductible HSA amount 1 Amy 40 7... View full answer

Get step-by-step solutions from verified subject matter experts