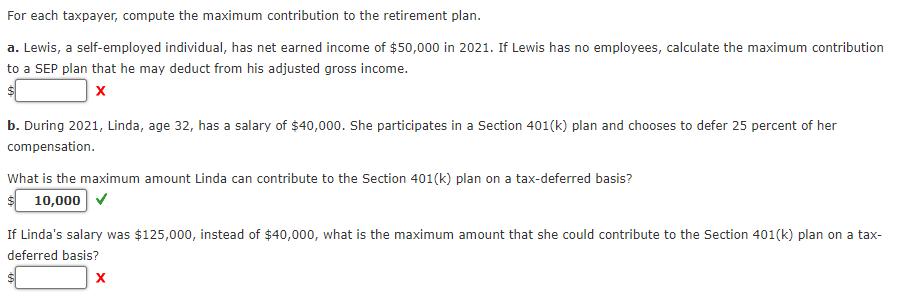

Question: For each taxpayer, compute the maximum contribution to the retirement plan. a. Lewis, a self-employed individual, has net earned income of $50,000 in 2021.

For each taxpayer, compute the maximum contribution to the retirement plan. a. Lewis, a self-employed individual, has net earned income of $50,000 in 2021. If Lewis has no employees, calculate the maximum contribution . to a SEP plan that he may deduct from his adjusted gross income. b. During 2021, Linda, age 32, has a salary of $40,000. She participates in a Section 401(k) plan and chooses to defer 25 percent of her compensation. What is the maximum amount Linda can contribute to the Section 401(k) plan on a tax-deferred basis? $ 10,000 V If Linda's salary was $125,000, instead of $40,000, what is the maximum amount that she could contribute to the Section 401(k) plan on a tax- deferred basis?

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

a A self employed individual can contribute up to the limit ... View full answer

Get step-by-step solutions from verified subject matter experts