Question: Self-Study Problem 5.9 In 2018, Eric gave $11,000 to his church. He donated $75 to Boy Scouts of America and $125 to the Mexican Red

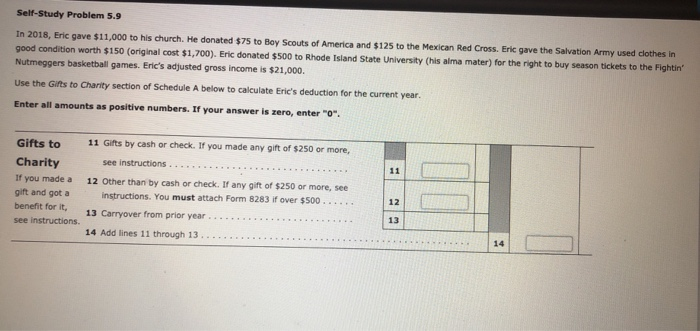

Self-Study Problem 5.9 In 2018, Eric gave $11,000 to his church. He donated $75 to Boy Scouts of America and $125 to the Mexican Red Cross, Eric gave the Salvation Army used clothes in good condition worth $150 (original cost $1,700). Eric donated $500 to Rhode Island State University (his alma mater) for the right to buy season tickets to the Fightin Nutmeggers basketball games. Eric's adjusted gross income is $21,000. Use the Gifts to Charity section of Schedule A below to calculate Eric's deduction for the current year. Enter all amounts as positive numbers. If your answer is zero, enter"0". Gifts to Charity If you made a gift and got a benefit for it. see instructions. 11 Gifts by cash or check. If you made any gift of $250 or more, see instructions ...... 12 Other than by cash or check. If any gift of $250 or more, see instructions. You must attach Form 6283 if over $500...... Cryover from prior year 14 Add lines 11 through 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts