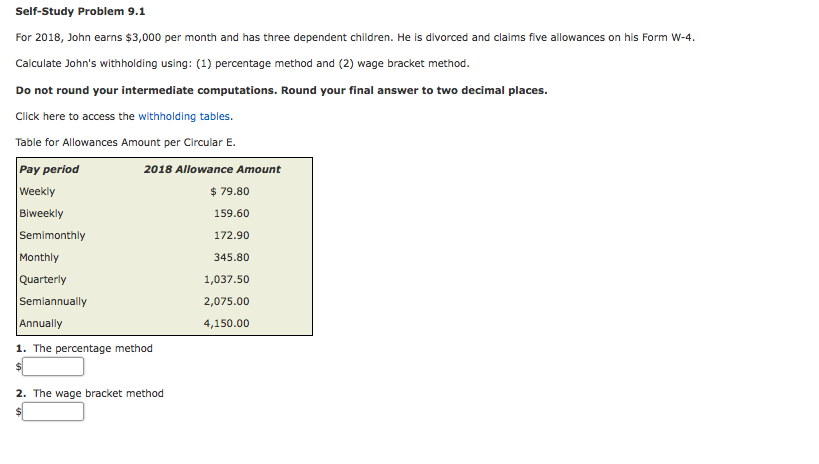

Question: Self-Study Problem 9.1 For 2018, John earns $3,000 per month and has three dependent children. He is divorced and claims five allowances on his Form

Self-Study Problem 9.1 For 2018, John earns $3,000 per month and has three dependent children. He is divorced and claims five allowances on his Form W-4 Calculate John's withholding using: (1) percentage method and (2) wage bracket method Do not round your intermediate computations. Round your final answer to two decimal places. Click here to access the withholding tables. Table for Allowances Amount per Circular E. Pay period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually 1. The percentage method 2018 Allowance Amount $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 2. The wage bracket method Self-Study Problem 9.1 For 2018, John earns $3,000 per month and has three dependent children. He is divorced and claims five allowances on his Form W-4 Calculate John's withholding using: (1) percentage method and (2) wage bracket method Do not round your intermediate computations. Round your final answer to two decimal places. Click here to access the withholding tables. Table for Allowances Amount per Circular E. Pay period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually 1. The percentage method 2018 Allowance Amount $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 2. The wage bracket method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts