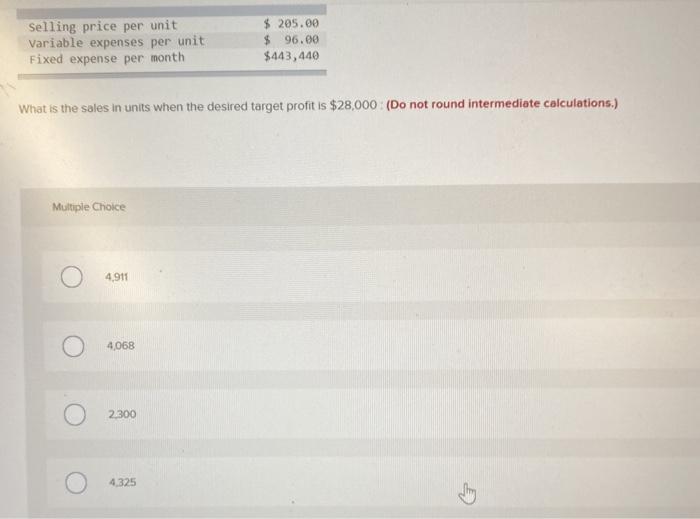

Question: Selling price per unit Variable expenses per unit Fixed expense per month $ 205.00 $ 96.00 $443,440 What is the sales in units when the

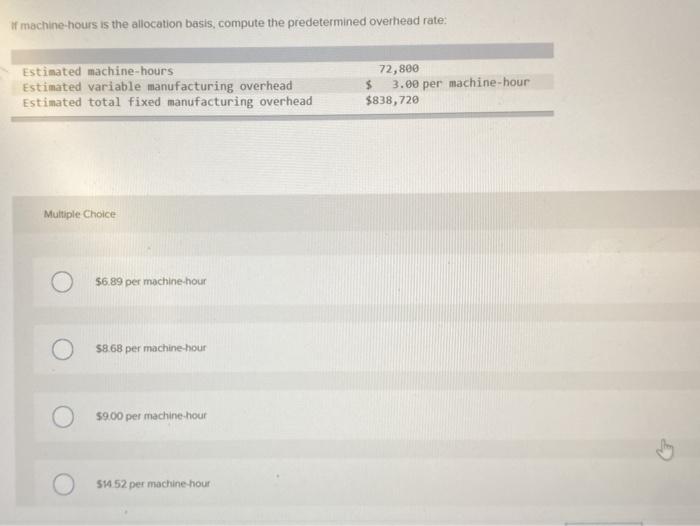

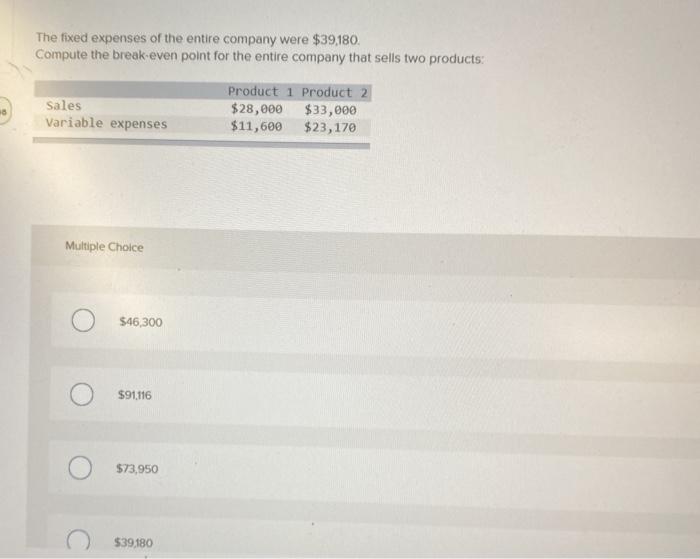

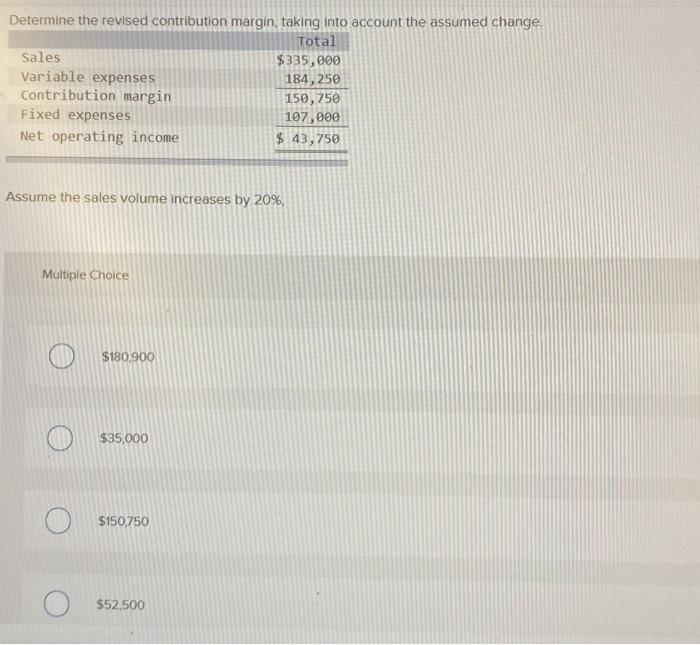

Selling price per unit Variable expenses per unit Fixed expense per month $ 205.00 $ 96.00 $443,440 What is the sales in units when the desired target profit is $28,000 : (Do not round intermediate calculations.) Multiple Choice 4,911 4,068 2.300 4.325 hy of machine-hours is the allocation basis, compute the predetermined overhead rate: Estimated machine-hours Estimated variable manufacturing overhead Estimated total fixed manufacturing overhead 72,800 $ 3.00 per machine-hour $838,720 Multiple Choice $6.89 per machine-hour 58.68 per machine hour $9.00 per machine-hour 51952 per machine hour The fixed expenses of the entire company were $39.180. Compute the break-even point for the entire company that sells two products: Sales Variable expenses Product 1 Product 2 $28,000 $33,000 $11,600 $23,170 Multiple Choice $46,300 $91,116 $73,950 $39,180 Determine the revised contribution margin, taking into account the assumed change Total Sales $335,000 Variable expenses 184,250 Contribution margin 150, 750 Fixed expenses 107,000 Net operating income $ 43,750 Assume the sales volume increases by 20%, Multiple Choice $180.900 $35,000 $150.750 $52,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts