Question: Semester Case - My Assistant, Inc. During the last three months April May, and Junel of the first fiscal year of operations of My Assistant,

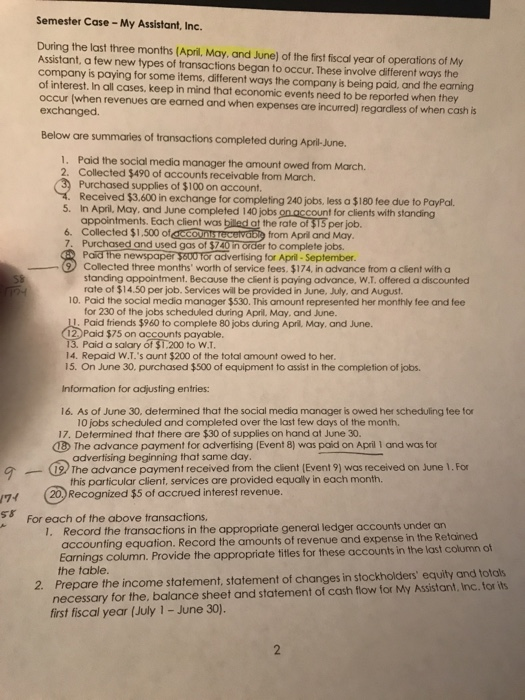

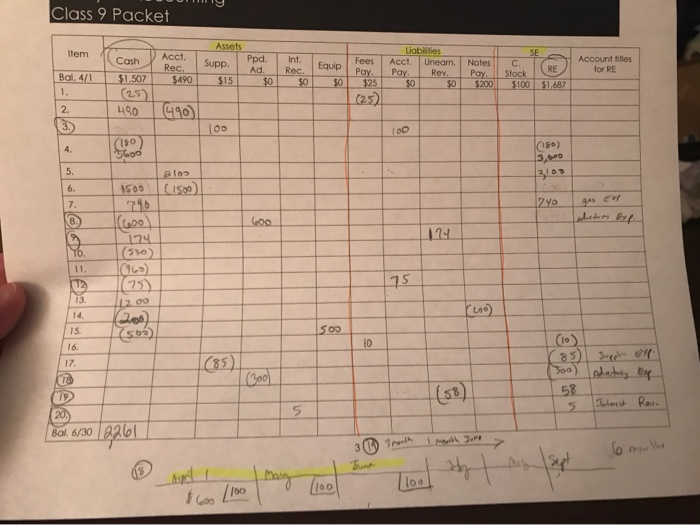

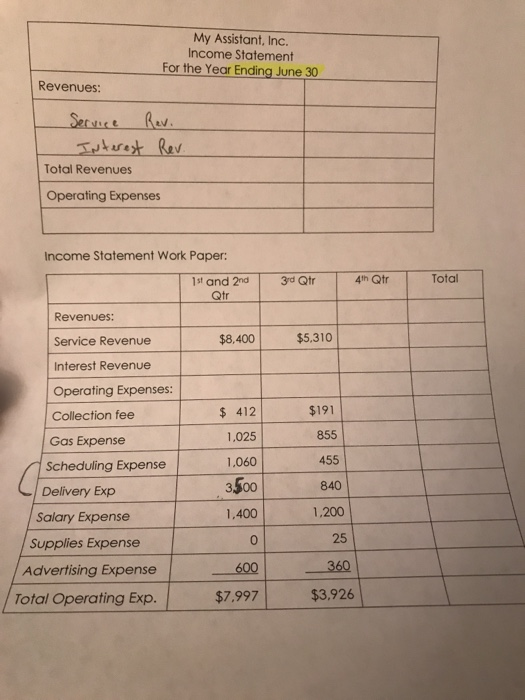

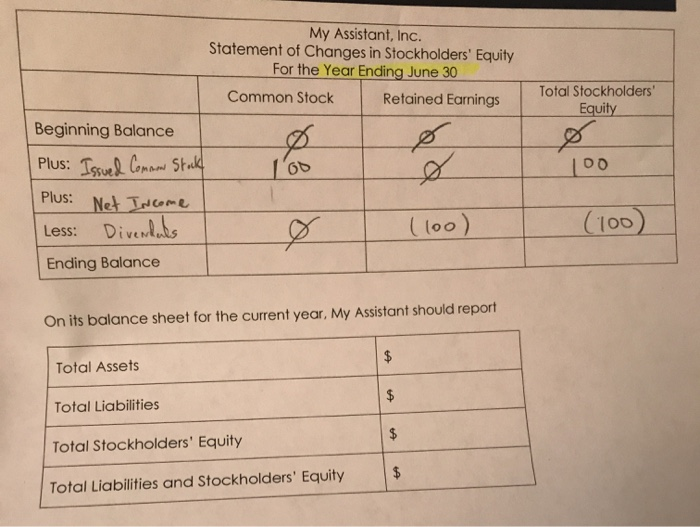

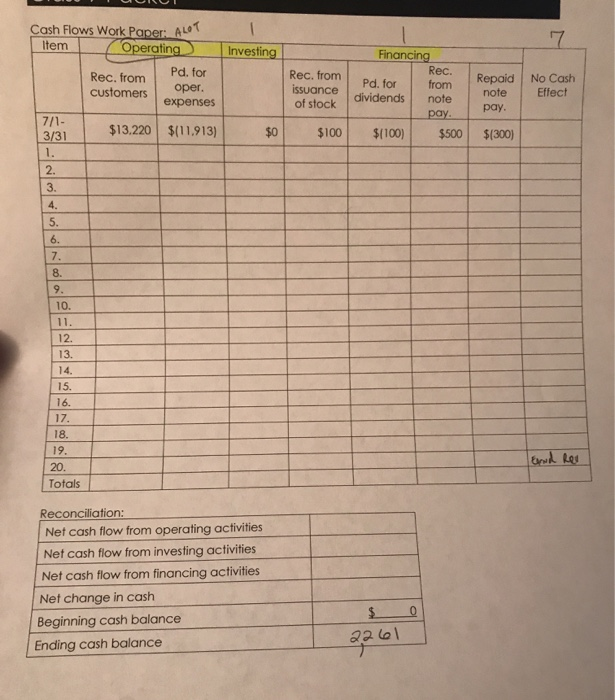

Semester Case - My Assistant, Inc. During the last three months April May, and Junel of the first fiscal year of operations of My Assistant, a few new types of transactions began to occur. These involve different ways the company is paying for some items, different ways the company is being paid, and the eaming of interest. In all cases, keep in mind that economic events need to be reported when they occur when revenues are eamed and when expenses are incurred) regardless of when cash is exchanged. Below are summaries of transactions completed during April-June. 1. Paid the social media manager the amount owed from March 2. Collected $490 of accounts receivable from March 3) Purchased supplies of $100 on account. 4. Received $3.600 in exchange for completing 240 jobs, less a $180 fee due to PayPal. 5. In April, May, and June completed 140 jobs on account for clients with standing appointments. Each client was billed at the rate of $15 per job. 6. Collected $1.500 of CCCOUNT Tecevable from April and May. 7. Purchased and used gas of $720 in order to complete jobs. Paid the newspaper $800 Tor advertising for April - September 9 Collected three months' worth of service fees. $174, in advance from a client with a standing appointment. Because the client is paying advance. W.L. offered a discounted rate of $14.50 per job. Services will be provided in June, July, and August 10. Paid the social media manager $530. This amount represented her monthly fee and fee for 230 of the jobs scheduled during April, May, and June. 11. Paid friends $960 to complete 80 jobs during April May, and June. (12 Paid $75 on accounts payable. 13. Paid a salary of $1.200 to W.T. 14. Repaid W.T.'s aunt $200 of the total amount owed to her. 15. On June 30, purchased $500 of equipment to assist in the completion of jobs. Information for adjusting entries: 16. As of June 30. determined that the social media manager is owed her scheduling fee for 10 jobs scheduled and completed over the last few days of the month 17. Determined that there are $30 of supplies on hand at June 30. 18 The advance payment for advertising (Event 8) was paid on April 1 and was for advertising beginning that same day. (12. The advance payment received from the client (Event 9) was received on June 1. For this particular client, services are provided equally in each month. (20.) Recognized $5 of accrued interest revenue. 24 s for each of the above transactions. 1. Record the transactions in the appropriate general ledger accounts under an accounting equation. Record the amounts of revenue and expense in the Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table. 2. Prepare the income statement, statement of changes in stockholders' equily and lotos necessary for the balance sheet and statement of cash flow for My Assistant, Inc. for its first fiscal year (July 1 - June 30). 0 Class 9 Packet Assets Item SE Cash Acct. Rec Int. SuppPpd. Pp. Account titles for RE Ad. Equip Rec. I Bal. 4/1 $490 $15 Liabilities Fees Acct. Unearn. PayPay Rev $25 $0 $0 (252 Notes Pay $200 C. Stock $100 $1,507 (25) 490 $1,687 (490) OD 190) 600 180) 3,600 Pion 310 | 1500 (1500) 240 (600 174 (530) 12.00 (56) 85 Super 30o) detary on 58 s Iuloust Revol Bol 6/308261 30 rih letih Sure $600 100 My Assistant, Inc. Income Statement For the Year Ending June 30 Revenues: Service Rev. Interest Rev. Total Revenues Operating Expenses 3d Qtr 4h Qtr Total $5,310 Income Statement Work Paper: 1st and 2nd Qlr Revenues: Service Revenue $8,400 Interest Revenue Operating Expenses: Collection fee $ 412 Gas Expense 1,025 Scheduling Expense 1,060 Delivery Exp 3.500 Salary Expense 1,400 Supplies Expense I Advertising Expense 600 Total Operating Exp. $7,997 $191 855 455 840 1.200 25 360 0 $3.926 My Assistant, Inc. Statement of Changes in Stockholders' Equity For the Year Ending June 30 Common Stock Retained Earnings Total Stockholders' Equity 100 Beginning Balance Plus: Issued Common Stock Plus: Net Income Less: Divendels Ending Balance (100) (100 On its balance sheet for the current year, My Assistant should report Total Assets Total Liabilities Total Stockholders' Equity Total Liabilities and Stockholders' Equity I Investing Cash Flows Work Paper: ALOT Item Operating Rec. from Pd. for customers oper. expenses $13.220 $(11.913) Rec. from issuance of stock Financing Rec. Pd. for from dividends note pay $(100) $500 Repaid note pay No Cash Effect $0 $100 $(300) 20. Totals Reconciliation: Net cash flow from operating activities Net cash flow from investing activities Net cash flow from financing activities Net change in cash Beginning cash balance Ending cash balance 22 0 Semester Case - My Assistant, Inc. During the last three months April May, and Junel of the first fiscal year of operations of My Assistant, a few new types of transactions began to occur. These involve different ways the company is paying for some items, different ways the company is being paid, and the eaming of interest. In all cases, keep in mind that economic events need to be reported when they occur when revenues are eamed and when expenses are incurred) regardless of when cash is exchanged. Below are summaries of transactions completed during April-June. 1. Paid the social media manager the amount owed from March 2. Collected $490 of accounts receivable from March 3) Purchased supplies of $100 on account. 4. Received $3.600 in exchange for completing 240 jobs, less a $180 fee due to PayPal. 5. In April, May, and June completed 140 jobs on account for clients with standing appointments. Each client was billed at the rate of $15 per job. 6. Collected $1.500 of CCCOUNT Tecevable from April and May. 7. Purchased and used gas of $720 in order to complete jobs. Paid the newspaper $800 Tor advertising for April - September 9 Collected three months' worth of service fees. $174, in advance from a client with a standing appointment. Because the client is paying advance. W.L. offered a discounted rate of $14.50 per job. Services will be provided in June, July, and August 10. Paid the social media manager $530. This amount represented her monthly fee and fee for 230 of the jobs scheduled during April, May, and June. 11. Paid friends $960 to complete 80 jobs during April May, and June. (12 Paid $75 on accounts payable. 13. Paid a salary of $1.200 to W.T. 14. Repaid W.T.'s aunt $200 of the total amount owed to her. 15. On June 30, purchased $500 of equipment to assist in the completion of jobs. Information for adjusting entries: 16. As of June 30. determined that the social media manager is owed her scheduling fee for 10 jobs scheduled and completed over the last few days of the month 17. Determined that there are $30 of supplies on hand at June 30. 18 The advance payment for advertising (Event 8) was paid on April 1 and was for advertising beginning that same day. (12. The advance payment received from the client (Event 9) was received on June 1. For this particular client, services are provided equally in each month. (20.) Recognized $5 of accrued interest revenue. 24 s for each of the above transactions. 1. Record the transactions in the appropriate general ledger accounts under an accounting equation. Record the amounts of revenue and expense in the Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table. 2. Prepare the income statement, statement of changes in stockholders' equily and lotos necessary for the balance sheet and statement of cash flow for My Assistant, Inc. for its first fiscal year (July 1 - June 30). 0 Class 9 Packet Assets Item SE Cash Acct. Rec Int. SuppPpd. Pp. Account titles for RE Ad. Equip Rec. I Bal. 4/1 $490 $15 Liabilities Fees Acct. Unearn. PayPay Rev $25 $0 $0 (252 Notes Pay $200 C. Stock $100 $1,507 (25) 490 $1,687 (490) OD 190) 600 180) 3,600 Pion 310 | 1500 (1500) 240 (600 174 (530) 12.00 (56) 85 Super 30o) detary on 58 s Iuloust Revol Bol 6/308261 30 rih letih Sure $600 100 My Assistant, Inc. Income Statement For the Year Ending June 30 Revenues: Service Rev. Interest Rev. Total Revenues Operating Expenses 3d Qtr 4h Qtr Total $5,310 Income Statement Work Paper: 1st and 2nd Qlr Revenues: Service Revenue $8,400 Interest Revenue Operating Expenses: Collection fee $ 412 Gas Expense 1,025 Scheduling Expense 1,060 Delivery Exp 3.500 Salary Expense 1,400 Supplies Expense I Advertising Expense 600 Total Operating Exp. $7,997 $191 855 455 840 1.200 25 360 0 $3.926 My Assistant, Inc. Statement of Changes in Stockholders' Equity For the Year Ending June 30 Common Stock Retained Earnings Total Stockholders' Equity 100 Beginning Balance Plus: Issued Common Stock Plus: Net Income Less: Divendels Ending Balance (100) (100 On its balance sheet for the current year, My Assistant should report Total Assets Total Liabilities Total Stockholders' Equity Total Liabilities and Stockholders' Equity I Investing Cash Flows Work Paper: ALOT Item Operating Rec. from Pd. for customers oper. expenses $13.220 $(11.913) Rec. from issuance of stock Financing Rec. Pd. for from dividends note pay $(100) $500 Repaid note pay No Cash Effect $0 $100 $(300) 20. Totals Reconciliation: Net cash flow from operating activities Net cash flow from investing activities Net cash flow from financing activities Net change in cash Beginning cash balance Ending cash balance 22 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts