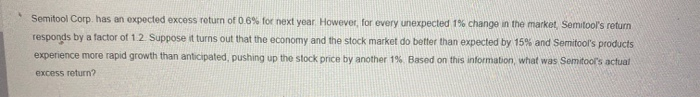

Question: Semitool Corp. has an expected excess return of 0.6% for next year However, for every unexpected 1% change in the market, Semifool's return responds by

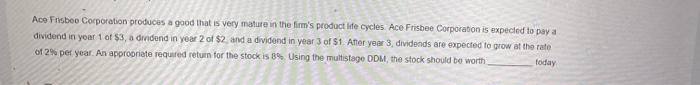

Semitool Corp. has an expected excess return of 0.6% for next year However, for every unexpected 1% change in the market, Semifool's return responds by a factor of 12 Suppose it turns out that the economy and the stock market do better than expected by 15% and Semitool's products experience more rapid growth than anticipated, pushing up the stock price by another 1% Based on this information, what was Somitool's actual excess return? Ace Frisbee Corporation produces a good that is very mature in the firm's product life cycles. Ace Frisbee Corporation is expected to pay a dividend in year 1 of $3, a dividend in year 2 of $2, and a dividend in year 3 of $1. After year 3, dividends are expected to grow at the rate today of 2% per year. An appropriate required return for the stock is 8%. Using the multistage DDM the stock should be worth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts