Question: senang mere Question Completion Status: QUESTION 4 4 points Save Answer On January 1, 2021, Coro granted stock options to key employees for the purchase

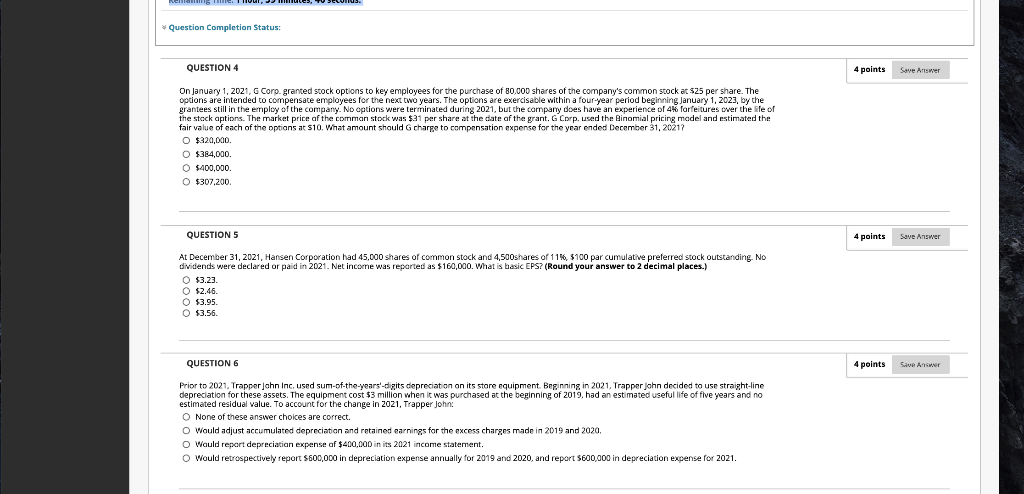

senang mere Question Completion Status: QUESTION 4 4 points Save Answer On January 1, 2021, Coro granted stock options to key employees for the purchase of 80.000 shares of the company's common stock at $25 per share. The options are intended to compensate employees for the next two years. The options are exercisable within a four-year period beginning January 1, 2023, by the grantees still in the employ of the company. No options were terminated during 2021, but the company does have an experience of 4 forfeitures over the life of the stock aptions. The market price of the common stock was $31 per share at the date of the grant. G Corp. used the Binomial pricing madel and estimated the fair value of each of the options at $10 What amount should G charge to compensation expense for the year ended December 31, 20217 O $320.000 O $384,000 $400,000 0 $307.200 QUESTION 5 4 points Save Answer At December 31, 2021, Hansen Corporation had 45,000 shares of common stock and 4,500shares of 11%, $100 par cumulative preferred stock outstanding. No dividends were declared or paid in 2021. Net income was reported as $160,000. What is basic EPS? (Round your answer to 2 decimal places.) O $3.23 O $2.46 O $3.95 $3.56. QUESTION 6 4 points Save Answer Prior to 2021. Trapper Jahn Inc, used sum-of-the-years-digits depreciation on its store equipment Beginning in 2021. Trapper john decided to use straight-line depreciation for these assets. The equipment cost $3 million when it was purchased at the beginning of 2019. had an estimated useful life of five years and no estimated residual value. To account for the change in 2021, Trapper John None of these answer choices are correct. O Would adjust accumulated depreciation and retained earnings for the excess charges made in 2019 and 2020, O Would report depreciation expense of $400,000 in its 2021 income statement. O Would retrospectively report 5500,000 in depreciation expense annually for 2019 and 2020, and report $600,000 in depreciation expense for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts