Question: send answer 1) a, 2)b etc Question 2 Homer is looking to buy a home with a price of $250,000. The bank is offering him

send answer 1) a, 2)b etc

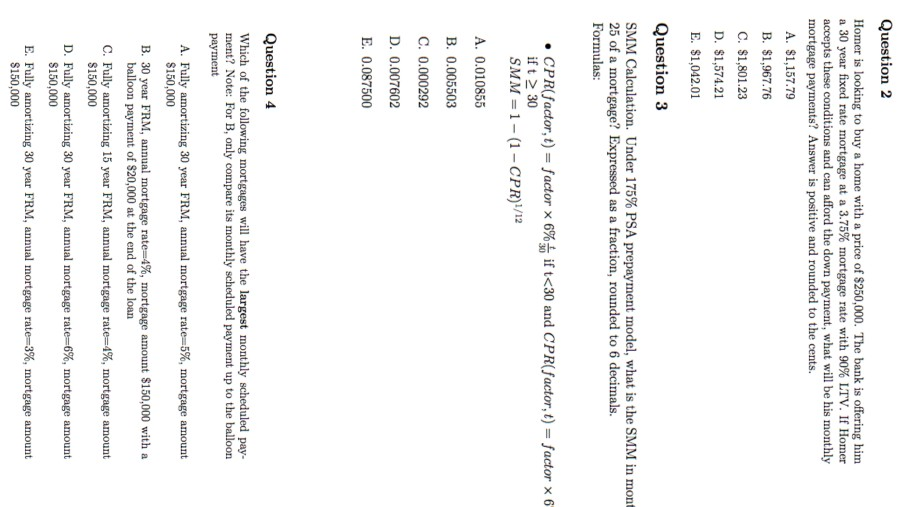

Question 2 Homer is looking to buy a home with a price of $250,000. The bank is offering him a 30 year fixed rate mortgage at a 3.75% mortgage rate with 90% LTV. If Homer accepts these conditions and can afford the down payment, what will be his monthly mortgage payments? Answer is positive and rounded to the cents. A. $1,157.79 B. $1,967.76 C. $1,801.23 D. $1,574.21 E. $1,042.01 Question 3 SMM Calculation. Under 175% PSA prepayment model, what is the SMM in mont 25 of a mortgage? Expressed as a fraction, rounded to 6 decimals. Formulas: if t 30 SMM = 1 -(1-CPR)/12 A. 0.010855 B. 0.005503 C. 0.000292 D. 0.007602 E. 0.087500 Question 4 Which of the following mortgages will have the largest monthly scheduled pay- ment? Note: For B, only compare its monthly scheduled payment up to the balloon payment A. Fully amortizing 30 year FRM, annual mortgage rate-5%, mortgage amount $150,000 B. 30 year FRM, annual mortgage rate=4%, mortgage amount $150,000 with a balloon payment of $20,000 at the end of the loan C. Fully amortizing 15 year FRM, annual mortgage rate1%, mortgage amount $150,000 D. Fully amortizing 30 year FRM, annual mortgage rate 6%, mortgage amount $150,000 E. Fully amortizing 30 year FRM, annual mortgage rate=3%, mortgage amount $150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts