Question: Send answer the questions please no explanation needed. Thank you! 1. A 4.25% coupon rate bond with 5 years left to maturity has a par

Send answer the questions please no explanation needed. Thank you!

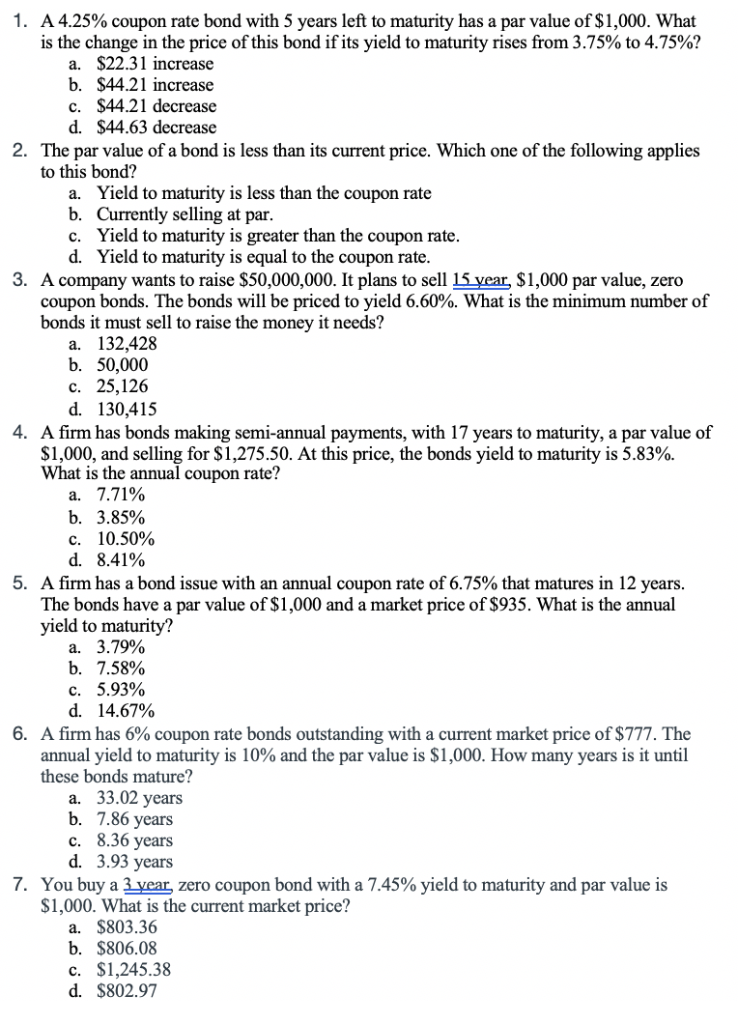

1. A 4.25% coupon rate bond with 5 years left to maturity has a par value of $1,000. What is the change in the price of this bond if its yield to maturity rises from 3.75% to 4.75%? a. $22.31 increase b. $44.21 increase c. $44.21 decrease d. $44.63 decrease 2. The par value of a bond is less than its current price. Which one of the following applies to this bond? Yield to maturity is less than the coupon rate b. a. Currently selling at par c. Yield to maturity is greater than the coupon rate d. Yield to maturity is equal to the coupon rate 3. A company wants to raise $50,000,000. It plans to sell L year, $1,000 par value, zero coupon bonds. The bonds will be priced to yield 6.60%. What is the minimum number of bonds it must sell to raise the money it needs? a. 132,428 b. 50,000 c. 25,126 d. 130,415 4. A firm has bonds making semi-annual payments, with 17 years to maturity, a par value of $1,000, and selling for $1,275.50. At this price, the bonds yield to maturity is 5.83%. What is the annual coupon rate? 7.71% a. b. 3.85% 10.50% 8.41% C. d. A firm has a bond issue with an annual coupon rate of 6.75% that matures in 12 years The bonds have a par value of $1,000 and a market price of $935. What is the annual yield to maturity? 5. a. b. c. d. 3.79% 7.58% 5.93% 14.67% 6. A firm has 6% coupon rate bonds outstanding with a current market price of $777. The annual yield to maturity is 10% and the par value is $1,000. How many years is it until these bonds mature? a. 33.02 years b. 7.86 years 8.36 years d. 3.93 years 7. You buy a year, zero coupon bond with a 7.45% yield to maturity and par value is $1,000. What is the current market price? a. $803.36 b. $806.08 c. $1,245.38 d. $802.97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts