Question: send me only final answer no need explanation. ok Good Morning Inc., reported net income of $273,000 for the year ended December 31, 2020. If

send me only final answer no need explanation. ok

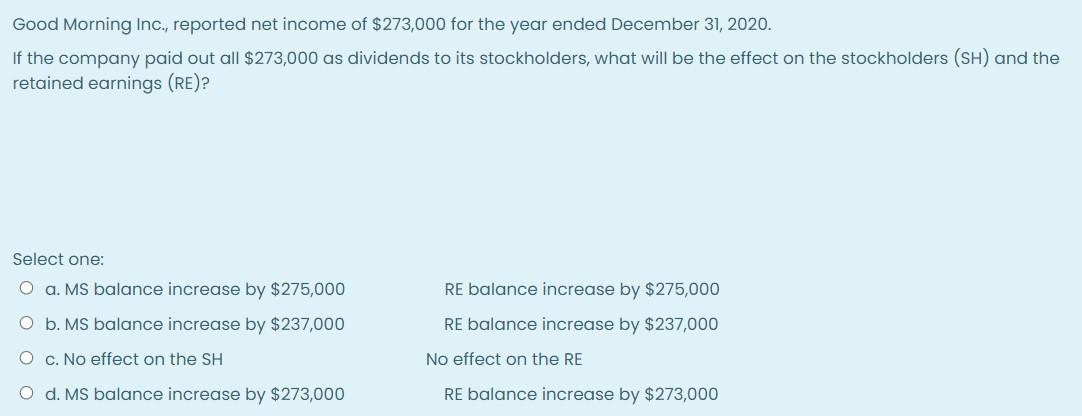

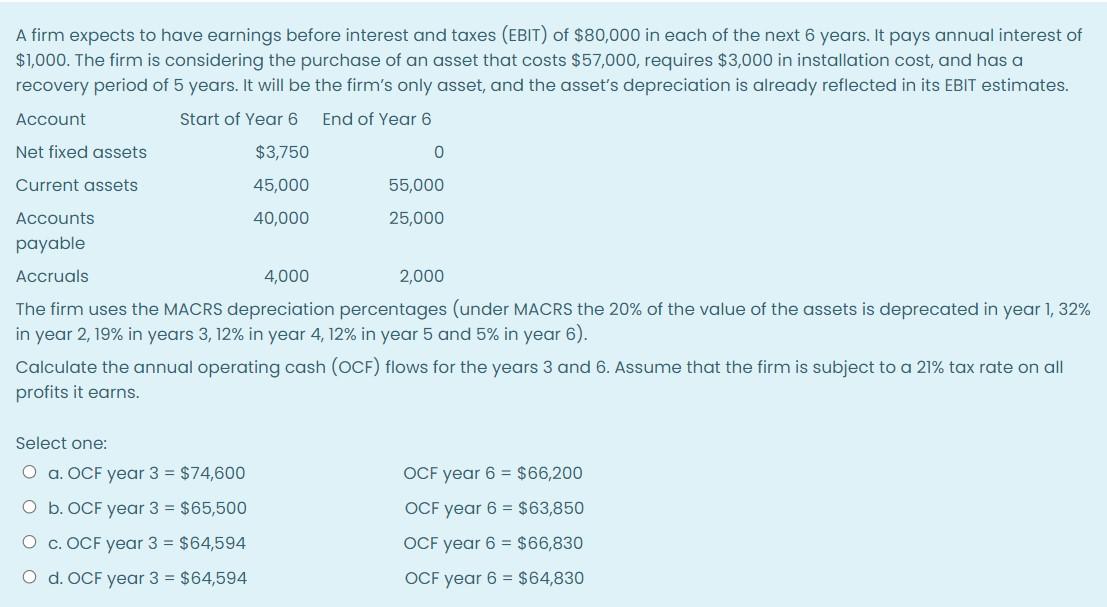

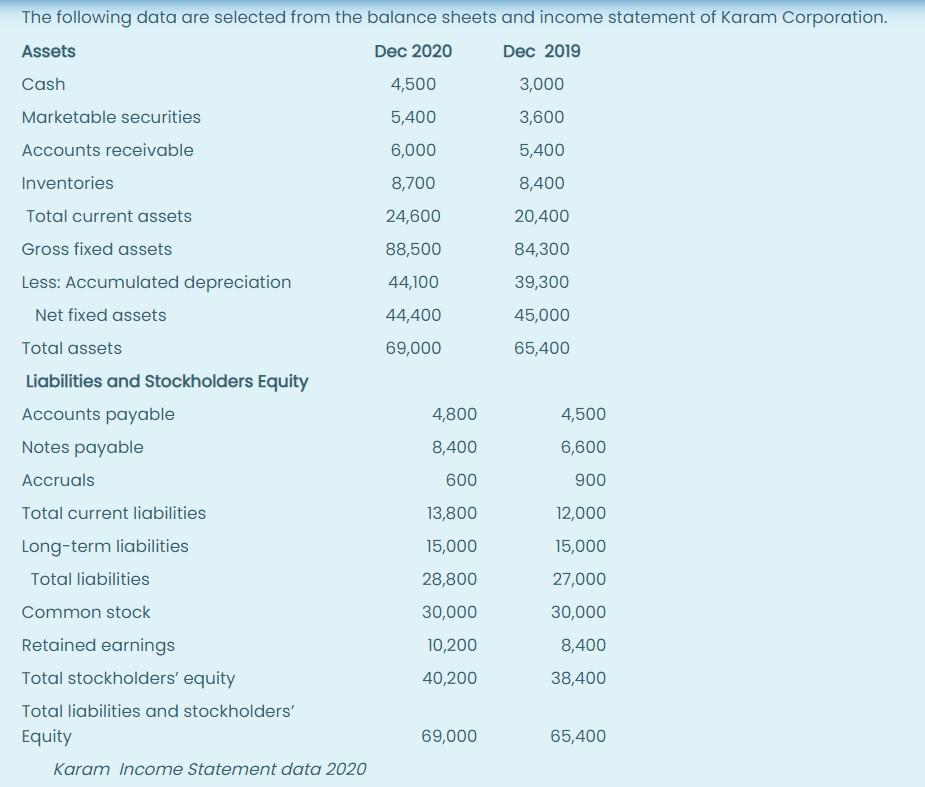

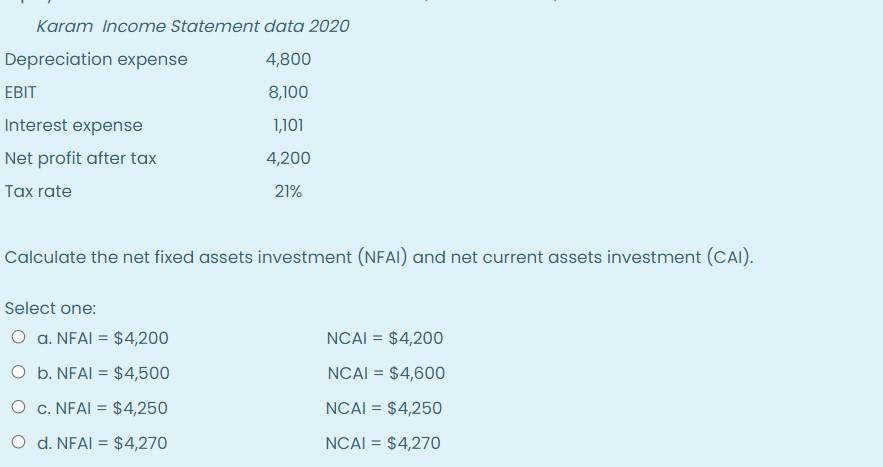

Good Morning Inc., reported net income of $273,000 for the year ended December 31, 2020. If the company paid out all $273,000 as dividends to its stockholders, what will be the effect on the stockholders (SH) and the retained earnings (RE)? Select one: O a. MS balance increase by $275,000 O b. MS balance increase by $237,000 RE balance increase by $275,000 RE balance increase by $237,000 O c. No effect on the SH No effect on the RE O d. MS balance increase by $273,000 RE balance increase by $273,000 A firm expects to have earnings before interest and taxes (EBIT) of $80,000 in each of the next 6 years. It pays annual interest of $1,000. The firm is considering the purchase of an asset that costs $57,000, requires $3,000 in installation cost, and has a recovery period of 5 years. It will be the firm's only asset, and the asset's depreciation is already reflected in its EBIT estimates. Account Start of Year 6 End of Year 6 Net fixed assets $3,750 0 Current assets 45,000 55,000 Accounts 40,000 25,000 payable Accruals 4,000 2,000 The firm uses the MACRS depreciation percentages (under MACRS the 20% of the value of the assets is deprecated in year 1, 32% in year 2, 19% in years 3,12% in year 4,12% in year 5 and 5% in year 6). Calculate the annual operating cash (OCF) flows for the years 3 and 6. Assume that the firm is subject to a 21% tax rate on all profits it earns. Select one: O a. OCF year 3 = $74,600 O b. OCF year 3 = $65,500 O c. OCF year 3 = $64,594 O d. OCF year 3 = $64,594 OCF year 6 = $66,200 OCF year 6 = $63,850 OCF year 6 = $66,830 OCF year 6 = $64,830 The following data are selected from the balance sheets and income statement of Karam Corporation. Assets Dec 2020 Dec 2019 Cash 4,500 3,000 Marketable securities 5,400 3,600 Accounts receivable 6,000 5,400 Inventories 8,700 8,400 Total current assets 24,600 20,400 Gross fixed assets 88,500 84,300 Less: Accumulated depreciation 44,100 39,300 Net fixed assets 44,400 45,000 Total assets 69,000 65,400 Liabilities and Stockholders Equity Accounts payable 4,800 4,500 Notes payable 8,400 6,600 Accruals 600 900 Total current liabilities 13,800 12,000 Long-term liabilities 15,000 15,000 Total liabilities 28,800 27,000 Common stock 30,000 30,000 Retained earnings 10,200 8,400 Total stockholders' equity 40,200 38,400 Total liabilities and stockholders' Equity 69,000 65,400 Karam Income Statement data 2020 Karam Income Statement data 2020 4,800 Depreciation expense EBIT 8,100 1,101 Interest expense Net profit after tax Tax rate 4,200 21% Calculate the net fixed assets investment (NFAI) and net current assets investment (CAI). Select one: O a. NFAI = $4,200 NCAL = $4,200 NCAI = $4,600 O b. NFAI = $4,500 O c. NFAI = $4,250 NCAI = $4,250 O d. NFAI = $4,270 NCAI = $4,270

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts