Question: send to expert Example 2 - 1 9 Matt Leonard earns $ 7 3 9 . 2 0 a week with fluctuating workweek hours. If

send to expert

Example

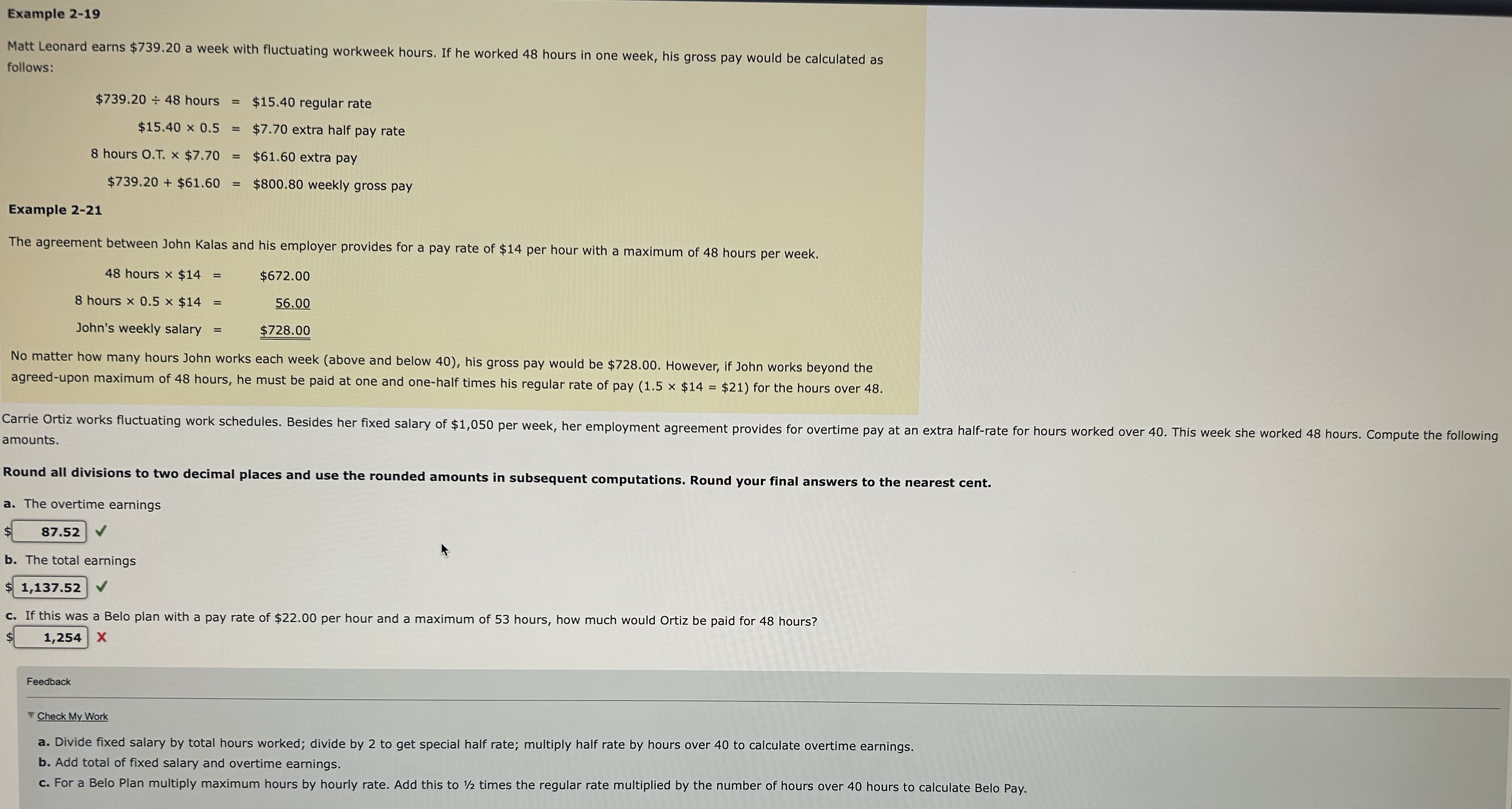

Matt Leonard earns $ a week with fluctuating workweek hours. If he worked hours in one week, his gross pay would be calculated as follows:

$ hours $ regular rate

$$ extra half pay rate

hours $$ extra pay

$$$ weekly gross pay

Example

The agreement between John Kalas and his employer provides for a pay rate of $ per hour with a maximum of hours per week.

hours $$

hours $

John's weekly salary $$

No matter how many hours John works each week above and below his gross pay would be $ However, if John works beyond the agreedupon maximum of hours, he must be paid at one and onehalf times his regular rate of pay $ for the hours over amounts.

Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent.

a The overtime earnings

b The total earnings

c If this was a Belo plan with a pay rate of $ per hour and a maximum of hours, how much would Ortiz be paid for hours?

Feedback

Check My Work

a Divide fixed salary by total hours worked; divide by to get special half rate; multiply half rate by hours over to calculate overtime earnings.

b Add total of fixed salary and overtime earnings.

c For a Belo Plan multiply maximum hours by hourly rate. Add this to times the regular rate multiplied by the number of hours over hours to calculate Belo Pay.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock