Question: Sendelbach Corporation is a US . based organization with operatons thoughout the world. Oee of its subsidianes is headquartered in Toronto, Canada. Athough this wholy

Sendelbach Corporation is a US based organization with operatons thoughout the world. Oee of its subsidianes is headquartered in Toronto, Canada. Athough this wholyowned subsidiary operates primarly in Canada, Engages in some transactions through a dollars ICSI. As of December the subsidiary is preparng finaticial statements in anticipation of consolidation with the US parent corporation. Both ledgers flor the subsidury are as follows:

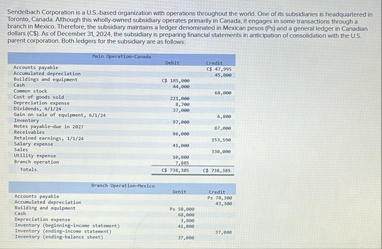

tablethrAccounts payalile,,C minAccumuluted duproulation,, thetfallesser and equipernt,CF CashCrimen stisck,,Cost of goods suld,Depretietisn expense,Plulflents APL thee,Gals as wie of equlpant, InswitaryWoter parabledier in easUsucelystlayBetainad marsing Naiery expunse,laiesunifity repener, seve,Jrameh eperation,TestatsCC

tabletyash sytrat lenflesterDebit,CrediteEccosste puybile,,Ps Acounalated depresiation,,Eallising and equipasint,Pr sim, mele,cathExpreciution #uptrise,Inventary eneingscose utatomewt Masmownery endingbalsace sheer

tablePurchasesMacelvableseve,Salary expense,SalesMain office,,TstalsFPy

Additional Information

The Canaduan subsidiary's functional currency is the Canadian dollat and Sendelibach's reporting currency is the US dollar. The Canadian and Mexican operations are not viewed as separate accounting entiles.

The building and equipment used in the Mexican operation were acquired in when the currency exchange rate wat Crs a Ps

Purcharies of inventory were made evenly throughout the flscal year

Beginning irrentory was acquired evenly throughout ending inventory was acquired evenly throughout

The Main Office account on the Mexican fecords thould be considered an equly account. This balance was remeasured into C $ on December

Currency exchange rates for Ps applicable to the Mexican operaton flollow

tableWeighted everage rate for Junwary Weighted mensuge rate fer Pettster

The December contelidated balance sheet reported a cumulative tramlation adjustment with a $ credit posove balance.

The subsidiary's corrmon stock was hiued in when the exchange rate was $ CS

The subsidarys December retained eamings balance was C an amount that has been translated into US

The applicable currency exchange rates for CS for translation purposes are as follows:

tableJewary Agerll E Wans Welghted swerage rett fler

Sectaler

Requlred:

a Remeasure the Mexican operation's accoon't balances into Canadan dollars. Note Back into the beginning net monetary asset or liability polation

b Prepare financial statements fincome stanement, staboment of netained earningn, and bolance sheeff for the Consusus to butury in Its functional currency, Canadign dollars

C Translate the Canadiun dollar functional curnency financial statements into US doilars so that Seriebthach can prepare consoldaned financial statements.

Complete this question by entering yeur annwers in the tabs below.

Fieq II and C asset or libility pootion.

mille: Input all amounts as peoilive valoes.

tableCanadun SullursOwbltCondrAcrounts payatif,,Acoumdatied depreciation,,Buldings and equipment,,CashDegreduelion supense,,Inveritory fleginning income statumest

Remeasure the Medcan operation's account balances into Canadlan dollars. Noter Rack intes the Beginning net monetary asset or lability position.

Note: Input all amounts as positive walues.

tableCansfian DollarsDestCreditAccourts payatile,,Acoumdated depreciation,,Buldings and equipment,,CashDepreciafion supense,,Inventary begirning incorse statementInsetory endingincome statumentWrentery endingtulasce sheelPurchasesReceivablesSadury sapense,,SalusMain office,,Tonal

Req A

Req B and C

b Prepare financial statements income statement, statement of retained earnings, and balance sheet for the Canadian subvidiary in its functional currency, Canadlan dollars.

c Translate the Canadian dollar functional currency financial statements into US dollars so that Sendebach can prepare consolidated finanolal statements.

Note: Round US Dollar values to decimal places. Amounts to be deducted and losses should be indicated with a minos sign.

Show lessa

tableSUMDELBACH CORPORNIONFinancial StatementsFor the Year EnStol December Canadi

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock