Question: Senior management is concerned about the recent developments in the financial markets. There is a general belief that market volatility has been relatively high, yet

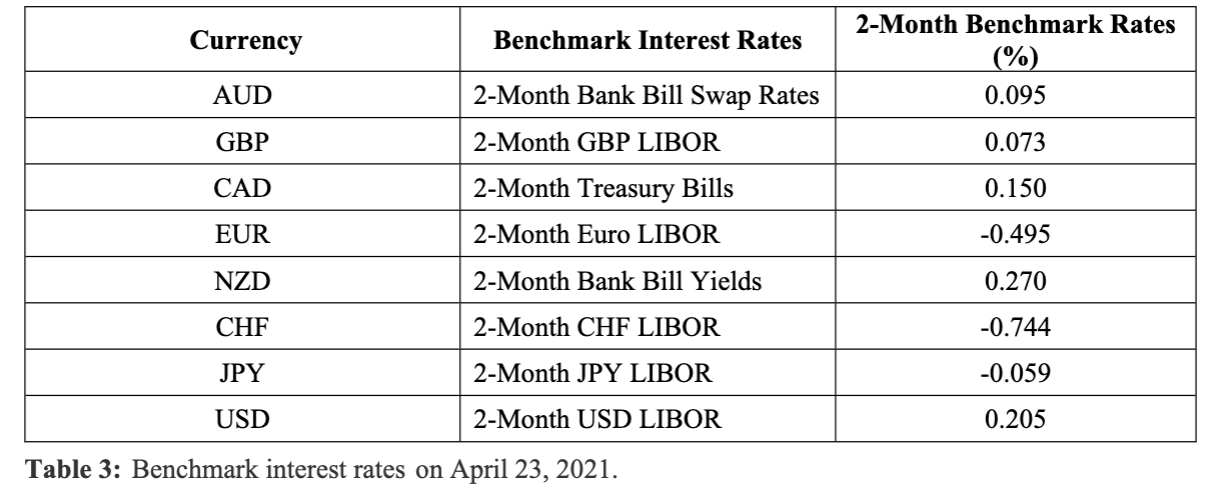

Senior management is concerned about the recent developments in the financial markets. There is a general belief that market volatility has been relatively high, yet it might climb even higher than expected in the near future due to the current global health crisis. You have been asked to conduct a thorough risk assessment of your speculative positions undertaken in question 1. For this purpose, the firms foreign currency analyst has provided you with the 2-month benchmark rates of these major currencies:

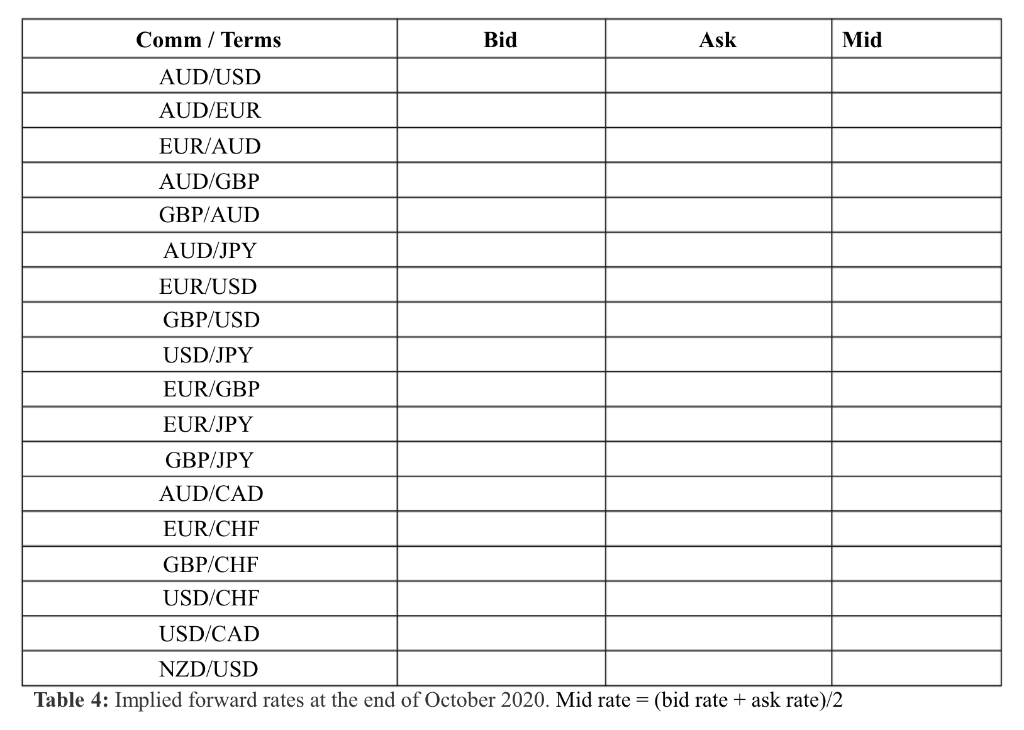

Using the interest rates above, calculate the implied forward bid, ask and mid rates for the currency pairs in Table 4 (next page) [3 Marks]. You must then calculate the value of your FX portfolio at the end of June using the calculated bid/ask rates. Report the expected value of your position in each currency in the position summary in Table 2 [2 Marks].

Currency Benchmark Interest Rates 2-Month Benchmark Rates (%) 0.095 AUD 2-Month Bank Bill Swap Rates GBP 2-Month GBP LIBOR 0.073 CAD 2-Month Treasury Bills 0.150 EUR 2-Month Euro LIBOR -0.495 NZD 2-Month Bank Bill Yields 0.270 CHF 2-Month CHF LIBOR -0.744 JPY 2-Month JPY LIBOR -0.059 USD 2-Month USD LIBOR 0.205 Table 3: Benchmark interest rates on April 23, 2021. Comm/ Terms Bid Ask Mid AUD/USD AUD/EUR EUR/AUD AUD/GBP GBP/AUD AUD/JPY EUR/USD GBP/USD USD/JPY EUR/GBP EUR/JPY GBP/JPY AUD/CAD EUR/CHF GBP/CHF USD/CHF USD/CAD NZD/USD Table 4: Implied forward rates at the end of October 2020. Mid rate = (bid rate + ask rate)/2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts