Question: SENSITIVITY ANALYSIS USING THREE ESTIMATES An engineer is evaluating three alternatives for new equipment at Emerson Electronics. She has made three estimates for the salvage

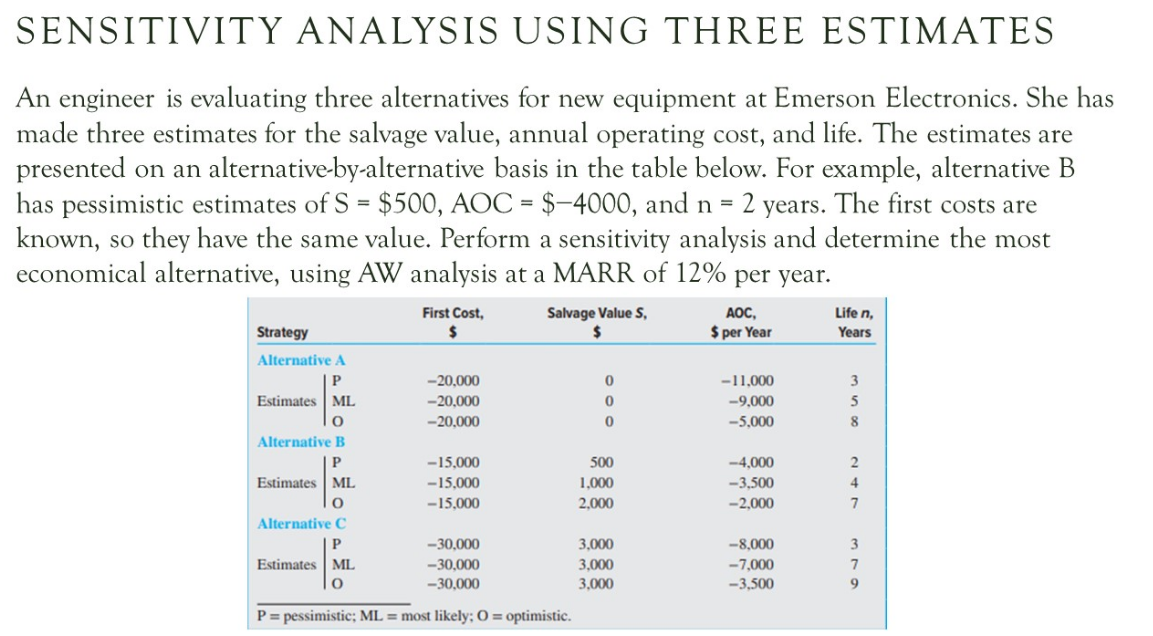

SENSITIVITY ANALYSIS USING THREE ESTIMATES An engineer is evaluating three alternatives for new equipment at Emerson Electronics. She has made three estimates for the salvage value, annual operating cost, and life. The estimates are presented on an alternative-by-alternative basis in the table below. For example, alternative B has pessimistic estimates of S = $500, AOC = $-4000, and n = 2 years. The first costs are known, so they have the same value. Perform a sensitivity analysis and determine the most economical alternative, using AW analysis at a MARR of 12% per year. AOC, Lifen, First Cost, $ Salvage Values, $ $ per Year Years 0 Strategy Alternative A P Estimates ML 0 Alternative B -20,000 - 20,000 -20,000 0 -11.000 -9,000 -5,000 3 5 8 0 - 15.000 - 15.000 -15.000 500 1.000 2.000 -4,000 -3,500 -2.000 4 7 Estimates ML O Alternative P Estimates ML 0 -30,000 -30,000 -30,000 3.000 3,000 3.000 -8.000 -7,000 -3,500 3 7 9 P = pessimistic; ML = most likely; O = optimistic. SENSITIVITY ANALYSIS USING THREE ESTIMATES An engineer is evaluating three alternatives for new equipment at Emerson Electronics. She has made three estimates for the salvage value, annual operating cost, and life. The estimates are presented on an alternative-by-alternative basis in the table below. For example, alternative B has pessimistic estimates of S = $500, AOC = $-4000, and n = 2 years. The first costs are known, so they have the same value. Perform a sensitivity analysis and determine the most economical alternative, using AW analysis at a MARR of 12% per year. AOC, Lifen, First Cost, $ Salvage Values, $ $ per Year Years 0 Strategy Alternative A P Estimates ML 0 Alternative B -20,000 - 20,000 -20,000 0 -11.000 -9,000 -5,000 3 5 8 0 - 15.000 - 15.000 -15.000 500 1.000 2.000 -4,000 -3,500 -2.000 4 7 Estimates ML O Alternative P Estimates ML 0 -30,000 -30,000 -30,000 3.000 3,000 3.000 -8.000 -7,000 -3,500 3 7 9 P = pessimistic; ML = most likely; O = optimistic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts