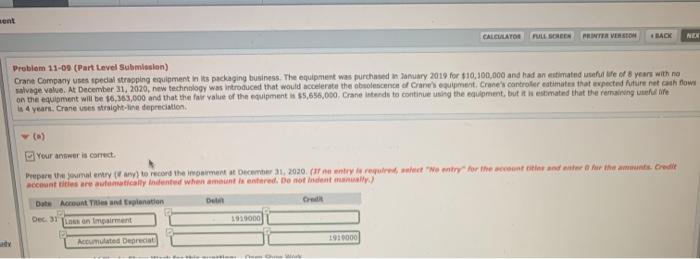

Question: sent CALCULATOR FULL SCREEN PRINTER VERSION LACK Problem 11-09 (Part Level Submission) Crane Company uses special strapping equipment in its packaging business. The equipment was

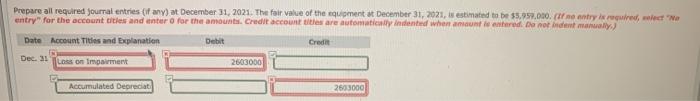

sent CALCULATOR FULL SCREEN PRINTER VERSION LACK Problem 11-09 (Part Level Submission) Crane Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2010 for $10,100,000 and had an estimated wife of 8 years with no salvage Valve At December 31, 2020, new technology was introduced that would corate the solescence Creument, Cranes controllerestimates that expected future net cash now on the equipment will be $6,363,000 and that the fair value of the equipment is 55,635,000 Crane Interdu to continue using the equipment, but it estimated that the remaining wife 4 years, Crane uses straight-line depreciation Your awer is correct Prepare the many way to record the inimenecm, 2030. Intyret med try for the countries and the mus Credit accounts are cally dented when amount is entired. Do not indentally Date Account and planation De Dec 31 an impairment 191000 Acumulated Deprecat 1910000 Prepare all required journal entries (if any) at December 31, 2021. The fair value of the equipment at December 31, 2021, is estimated to be $5.999.000. Inntry is required, electe entry for the account cities and enter for the amount Credit account titles are automatically indented when amount is entered Damor det manually) Date Account Tities and Explanation Debit Credit Dec. 31 us on Impairment 2603000 Accumulated Depreciat 2603000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts