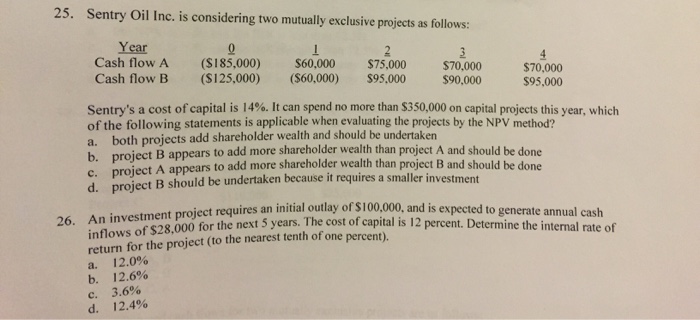

Question: Sentry Oil Inc. is considering two mutually exclusive projects as follows: Sentry's a cost of capital is 14%. It can spend no more lhan $350,000

Sentry Oil Inc. is considering two mutually exclusive projects as follows: Sentry's a cost of capital is 14%. It can spend no more lhan $350,000 on capital projects this year, which of the following statements is applicable when evaluating the projects by the NPV method? a. both projects add shareholder wealth and should be undertaken b. project B appears to add more shareholder wealth than project A and should be done c. project A appears to add more shareholder wealth than project B and should be done d. project B should be undertaken because it requires a smaller investment 26. An investment project requires an initial outlay of $100,000, and is expected to generate annual cash inflows of $28,000 for the next 5 years. The cost of capital is 12 percent. Determine the internal rate of return for the project (to the nearest tenth of one percent). a. 12.0% b. 126% c. 3.6% d. 12.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts