Question: Separated by more than 3,000 nautical miles and five time zones, money and foreign exchange markets in both London and New York are very efficient.

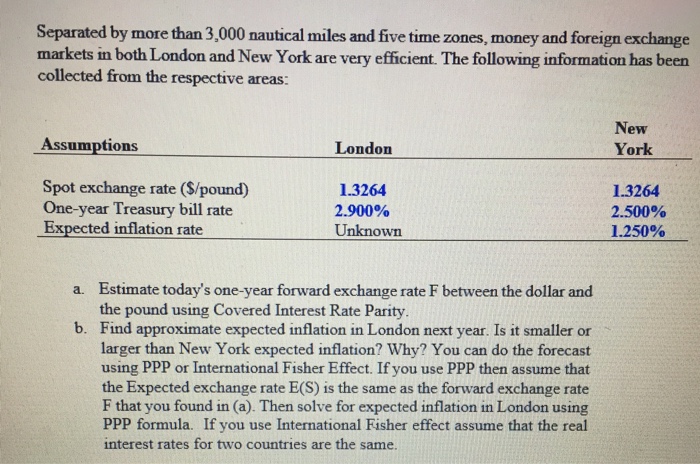

Separated by more than 3,000 nautical miles and five time zones, money and foreign exchange markets in both London and New York are very efficient. The following information has been collected from the respective areas: New York Assumptions London Spot exchange rate (S/pound) One-year Treasury bill rate Expected inflation rate 1.3264 2.900% Unknown 1.3264 2.500% 1.250% Estimate today's one-year forward exchange rate F between the dollar and the pound using Covered Interest Rate Parity Find approximate expected inflation in London next year. Is it smaller or larger than New York expected inflation? Why? You can do the forecast using PPP or International Fisher Effect. If you use PPP then assume that the Expected exchange rate E(S) is the same as the forward exchange rate F that you found in (a). Then solve for expected inflation in London using PPP formula. If you use International Fisher effect assume that the real interest rates for two countries are the same. a. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts