Question: SEPTEMBER 2 0 2 2 1 . Lotus Machine Sdn Bhd was newly incorporated on 1 8 . 5 . 2 0 1 9 with

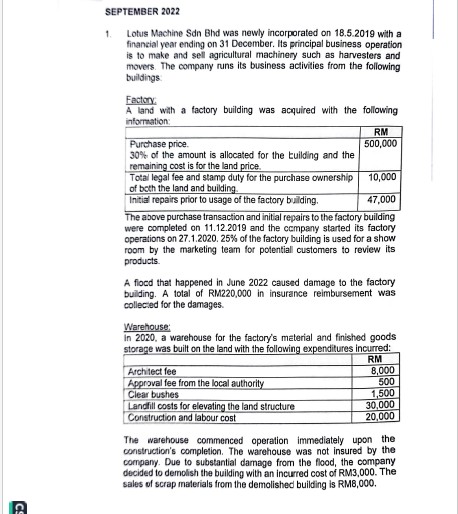

SEPTEMBER Lotus Machine Sdn Bhd was newly incorporated on with a financial year ending on December. Its principal business operation is to make and sell agricultural machinery such as harvesters and movers. The company runs its business activities from the following buildings: Factor: A land with a factory building was acquired with the following information: The above purchase transaction and initial repairs to the factory building were completed on and the ccmpany started its factory operations on of the factory building is used for a show room by the marketing team for potential customers to review its products. A flocd that happened in June caused damage to the factory building. A total of RM in insurance reimbursement was collecisd for the damages. Warehouse: In a warehouse for the factory's material and finished goods storage was built on the land with the following expenditures incurred: The warehouse commenced operation immediately upon the construction's completion. The warehouse was not insured by the company. Due to substantial damage from the flood, the company decided to demolish the building with an incurred cost of RM The sales of scrap materials from the demolished building is RM Cate:

In August the company purchased a large shippingstorage container for RM The company further insurred RM to install and modify it to become a caf with a permanent structure at the factory prenise. It was being rented to a food operator for the factory staff's benefits.

Workshop:

A workshop was built at the factory premise to repair the faulty machine after its sale within the warranty period. The workshop building construction cost incurred was RM in

Hostel:

In Cctober a house was rented adjacent to the factory premise for accommodation of its factory staff. The company incurred RM in renovations of the house prior to its usage as a hostel.

Required:

a Justify whether each of the above premises qualifies for an industrial building allowance IBA in the year it incurs.

marks

b Calculate the IBA for the relevant year assessments YA until the YA wherever applicable. Show the calculation separately for each relevant building.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock