Question: SERIAL CORRELATION. For this and the next question. In a time series regression, exchange rate ( ( mathrm { Y } )

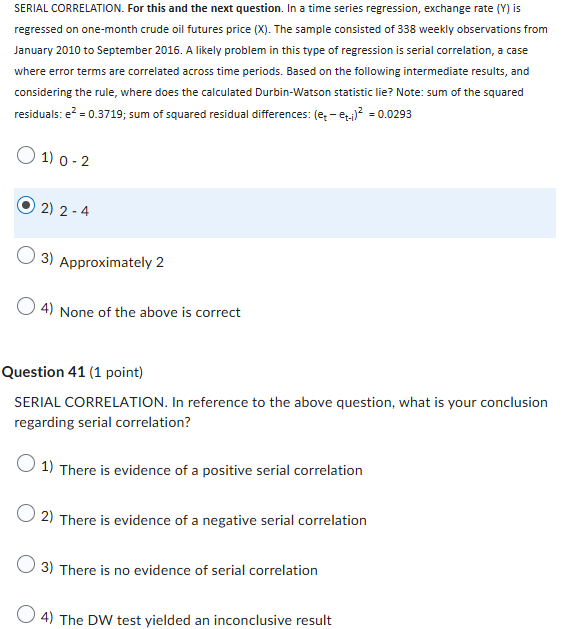

SERIAL CORRELATION. For this and the next question. In a time series regression, exchange rate mathrmY is regressed on onemonth crude oil futures price X The sample consisted of weekly observations from January to September A likely problem in this type of regression is serial correlation, a case where error terms are correlated across time periods. Based on the following intermediate results, and considering the rule, where does the calculated DurbinWatson statistic lie? Note: sum of the squared residuals: e; sum of squared residual differences: leftetetiright

Approximately

None of the above is correct

Question point

SERIAL CORRELATION. In reference to the above question, what is your conclusion regarding serial correlation?

There is evidence of a positive serial correlation

There is evidence of a negative serial correlation

There is no evidence of serial correlation

The DW test yielded an inconclusive result

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock