Question: Serial Problem Business Solutions LO P2, P3 The December 31, 2019, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of

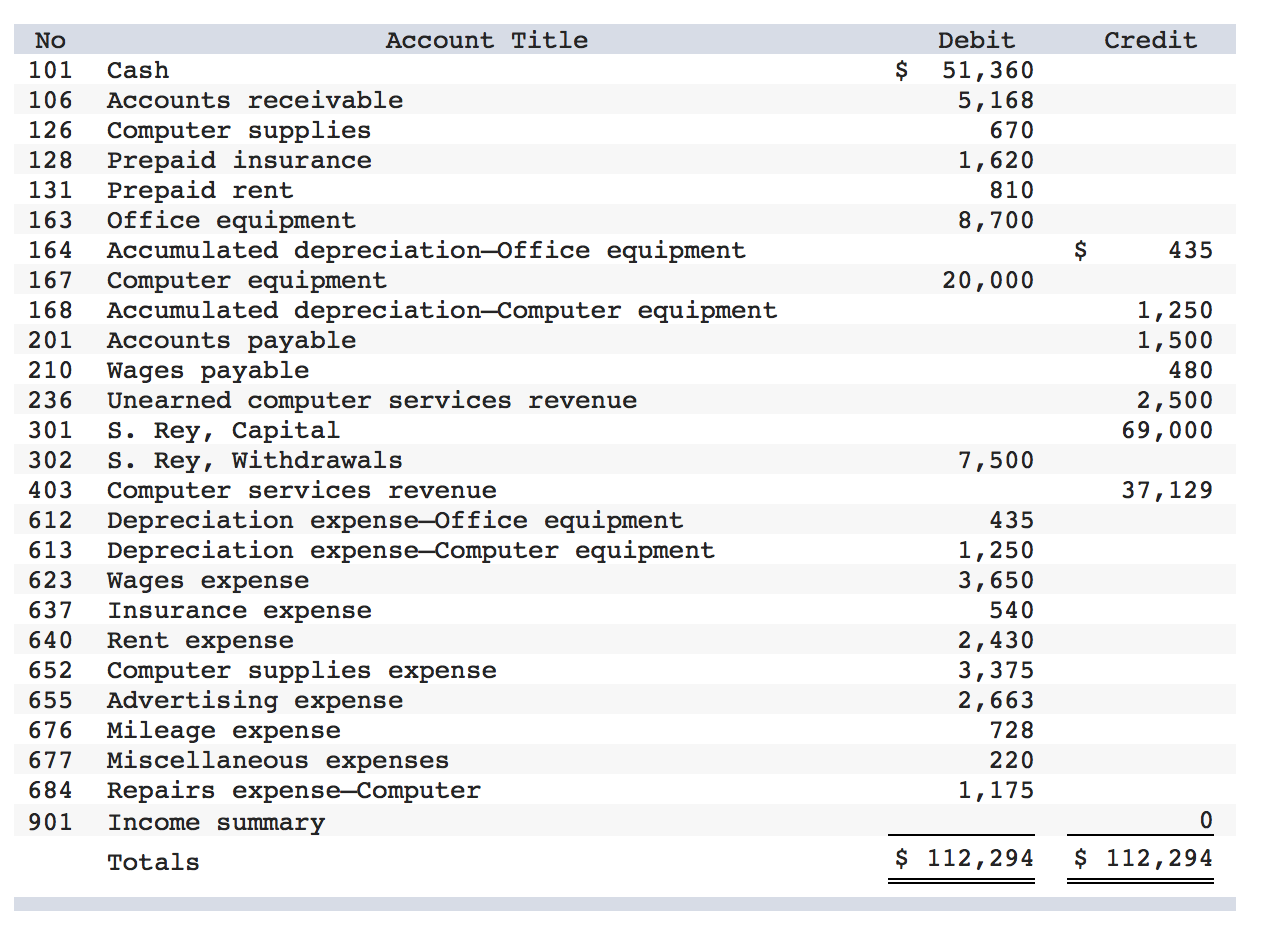

Serial Problem Business Solutions LO P2, P3 The December 31, 2019, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of 2019) follows. Credit $ Debit 51,360 5,168 670 1,620 810 8,700 $ 435 20,000 NO 101 106 126 128 131 163 164 167 168 201 210 236 301 302 403 612 613 623 637 640 652 655 676 677 684 901 1,250 1,500 480 2,500 69,000 Account Title Cash Accounts receivable Computer supplies Prepaid insurance Prepaid rent Office equipment Accumulated depreciation Office equipment Computer equipment Accumulated depreciation-Computer equipment Accounts payable Wages payable Unearned computer services revenue S. Rey, Capital S. Rey, Withdrawals Computer services revenue Depreciation expense-Office equipment Depreciation expense-Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer Income summary Totals 7,500 37, 129 435 1,250 3,650 540 2,430 3,375 2,663 728 220 1,175 0 $ 112,294 $ 112,294 Required: 1. Record the closing entries as of December 31, 2019. 2. Prepare a post-closing trial balance as of December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts