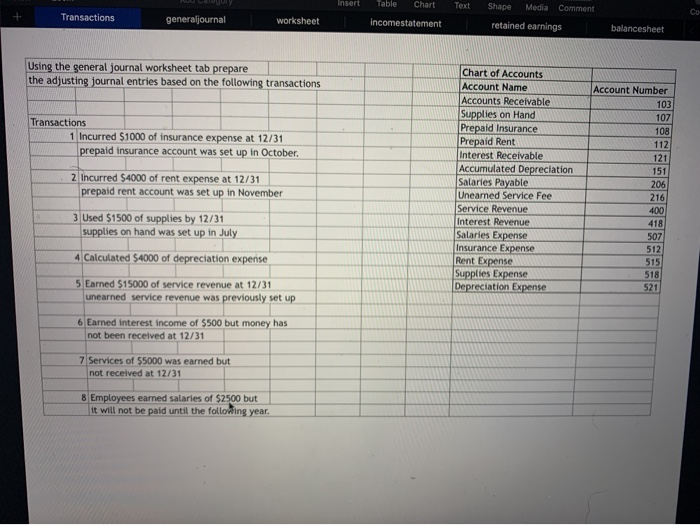

Question: sert Text Table Chart incomestatement Shape Media Comment retained earnings Transactions generaljournal worksheet balancesheet Using the general journal worksheet tab prepare the adjusting journal entries

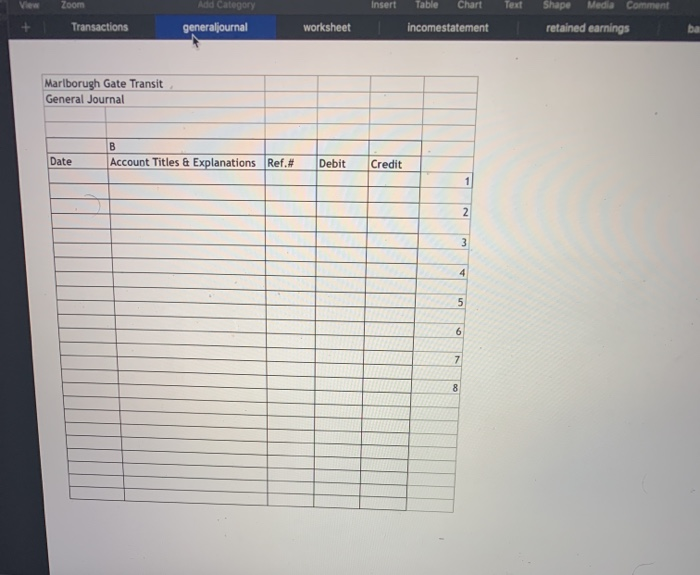

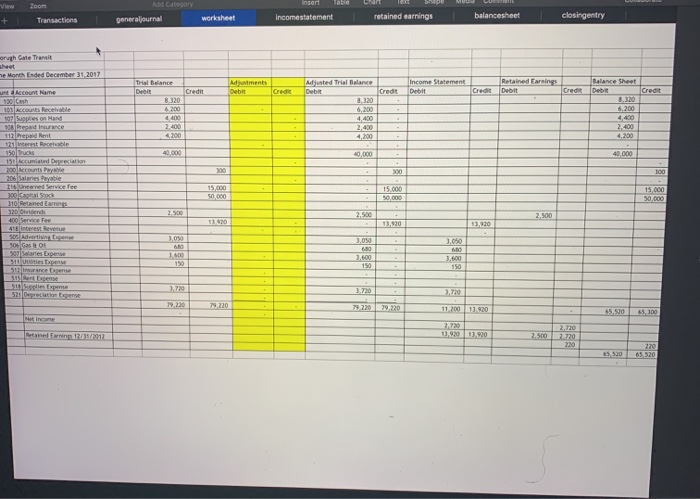

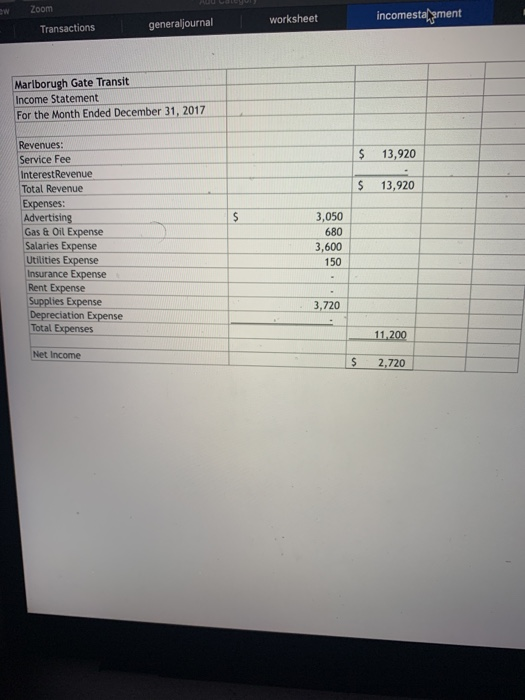

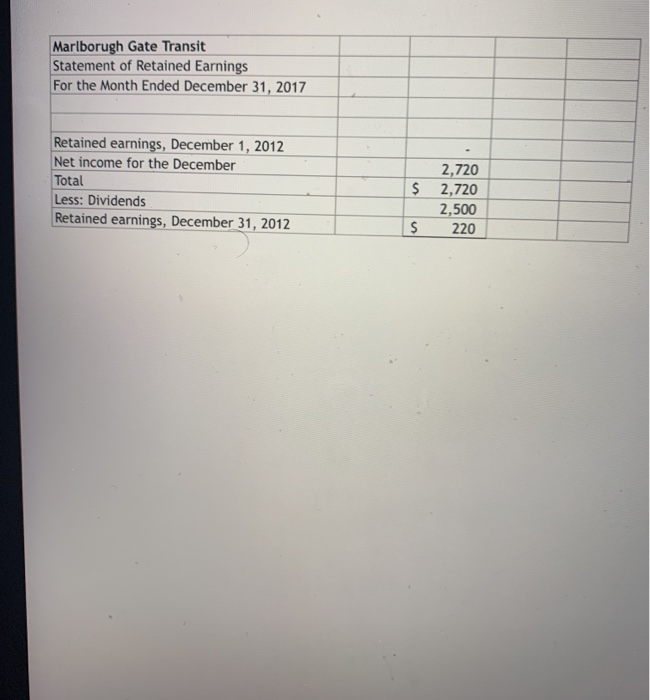

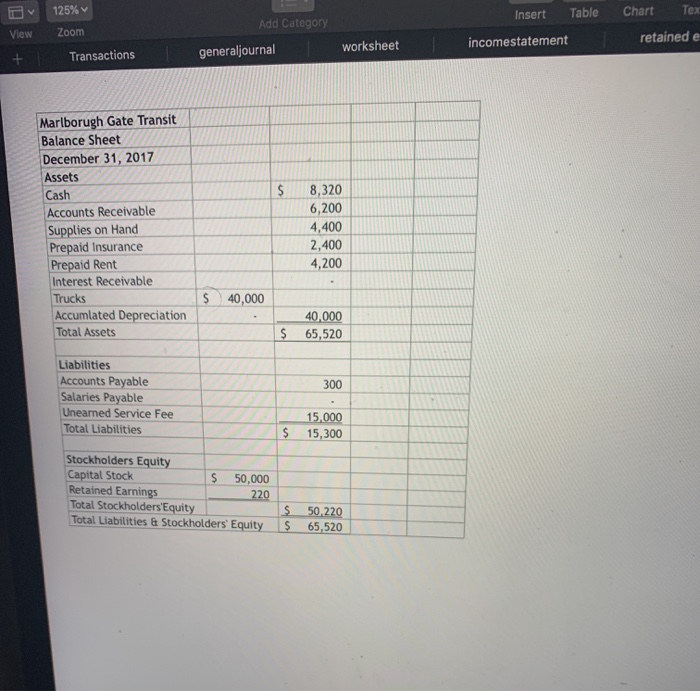

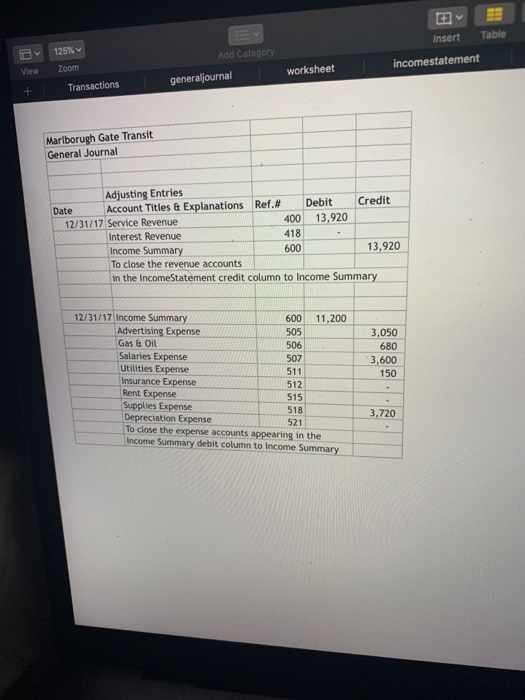

sert Text Table Chart incomestatement Shape Media Comment retained earnings Transactions generaljournal worksheet balancesheet Using the general journal worksheet tab prepare the adjusting journal entries based on the following transactions Transactions 1 Incurred $1000 of insurance expense at 12/31 prepaid insurance account was set up in October Account Number 1 103 107 108 112 121 151 2 incurred $4000 of rent expense at 12/31 prepaid rent account was set up in November Chart of Accounts Account Name Accounts Receivable Supplies on Hand Prepaid Insurance Prepaid Rent Interest Receivable Accumulated Depreciation Salaries Payable Uneamed Service Fee Service Revenue Interest Revenue Salaries Expense Insurance Expense Rent Expense Supplies Expense Depreciation Expense 206 216 3 Used $1500 of supplies by 12/31 supplies on hand was set up in July 418 507 512 515 4 Calculated $4000 of depreciation expense 518 521 5 Earned 515000 of service revenue at 12/31 unearned service revenue was previously set up 6 Earned interest income of $500 but money has not been received at 12/31 7 Services of $5000 was earned but not received at 12/31 8 Employees earned salaries of $2500 but It will not be paid until the following year. Insert Taule + incomestatement retained earnings generaljournal worksheet Transactions Mariborugh Gate Transit General Journal Date Account Titles & Explanations Ref.# Debit Credit Transactions generator worksheet Income statement retained earnings balancesheet closingentry Morth Ended December 31, 2017 accounts Rece Soples on Hand 206 Salaries Royable 216 med Service fee 310 Penedig 320 Olidende 400 Service Fee 413 Interest Revenue antes per 511 Spies en 11.2001.920 1903.90 Zoom incomesta ement worksheet Transactions generaljournal Marlborugh Gate Transit Income Statement For the Month Ended December 31, 2017 $ 13,920 $ 13,920 Revenues: Service Fee Interest Revenue Total Revenue Expenses: Advertising Gas & Oil Expense Salaries Expense Utilities Expense Insurance Expense Rent Expense Supplies Expense Depreciation Expense Total Expenses 3,050 680 3,600 150 3,720 11.200 Net Income $ 2,720 Marlborugh Gate Transit Statement of Retained Earnings For the Month Ended December 31, 2017 Retained earnings, December 1, 2012 Net income for the December Total Less: Dividends Retained earnings, December 31, 2012 $ 2,720 2,720 2,500 220 $ B View 125% Zoom Transactions Add Category generaljournal Insert Table incomestatement Chart Tex retained e worksheet Marlborugh Gate Transit Balance Sheet December 31, 2017 Assets Cash Accounts Receivable Supplies on Hand Prepaid Insurance Prepaid Rent Interest Receivable Trucks Accumlated Depreciation Total Assets 8,320 6,200 4,400 2,400 4,200 $ 40,000 . 40,000 65,520 $ 300 Liabilities Accounts Payable Salaries Payable Uneared Service Fee Total Liabilities $ 15.000 15,300 Stockholders Equity Capital Stock $ 50,000 Retained Earnings 220 Total Stockholders'Equity Total Liabilities & Stockholders' Equity $ $ 50.220 65,520 Insert Table B 125% Zoom incomestatement View Add Category generaljournal worksheet Transactions Marlborugh Gate Transit General Journal Adjusting Entries Debit Account Titles & Explanations Ref.# Credit Date 112/31/17 Service Revenue 400 13,920 Interest Revenue 418 Income Summary 13,920 To close the revenue accounts in the Income Statement credit column to Income Summary 600 3,050 680 3,600 150 12/31/17 Income Summary 600 11,200 Advertising Expense 505 Gas & Oil 506 Salaries Expense 507 Utilities Expense 511 Insurance Expense 512 Rent Expense 515 Supplies Expense 518 Depreciation Expense To close the expense accounts appearing in the Income Summary debit column to Income Summary 3.720

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts