Question: Served Helps Required information E8-9 Recording and Determining the Effects of Write-Offs, Recoveries, and Bad Debt Expense Estimates on the Balance Sheet and Income Statement

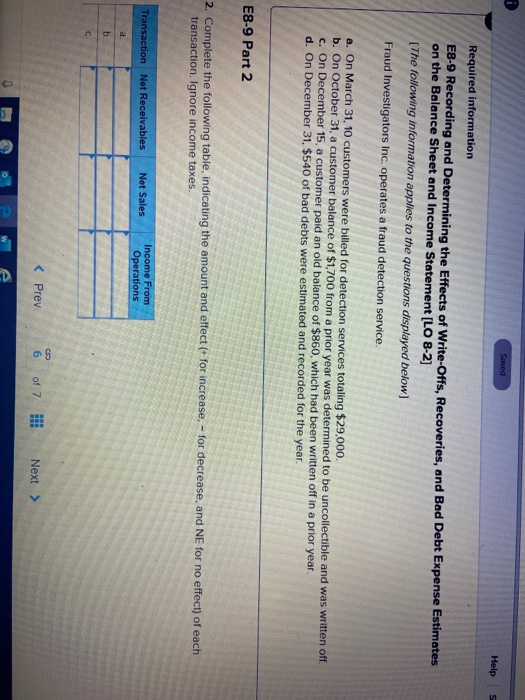

Served Helps Required information E8-9 Recording and Determining the Effects of Write-Offs, Recoveries, and Bad Debt Expense Estimates on the Balance Sheet and Income Statement [LO 8-2] The following information applies to the questions displayed below) Fraud Investigators Inc. operates a fraud detection service. a. On March 31, 10 customers were billed for detection services totaling $29.000 b. On October 31, a customer balance of $1,700 from a prior year was determined to be uncollectible and was written off. c. On December 15, a customer paid an old balance of $860, which had been written off in a prior year. d. On December 31, $540 of bad debts were estimated and recorded for the year. E8-9 Part 2 2. Complete the following table, indicating the amount and effect (+ for increase. - for decrease, and NE for no effect) of each transaction. Ignore income taxes. Transaction Net Receivables Net Sales Income From Operations O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts