Question: Service Co. - CAPITAL PROJECT ANALYSIS - CHAPTER 10 HW ON CANVAS Service Co. is evaluating which of two machines has the most favorable equivalent

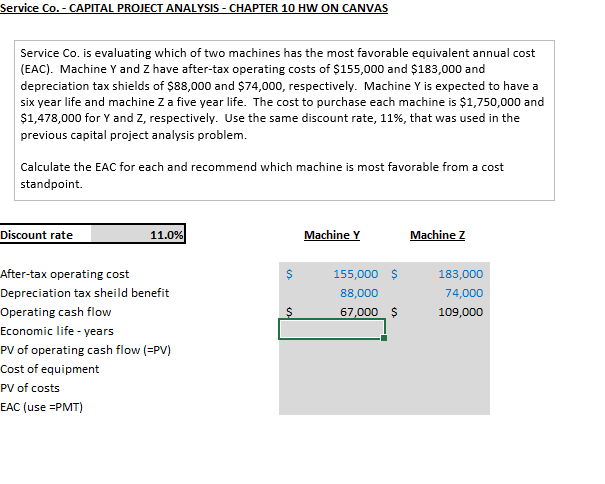

Service Co. - CAPITAL PROJECT ANALYSIS - CHAPTER 10 HW ON CANVAS Service Co. is evaluating which of two machines has the most favorable equivalent annual cost (EAC). Machine Y and Z have after-tax operating costs of $155,000 and $183,000 and depreciation tax shields of $88,000 and $74,000, respectively. Machine Y is expected to have a six year life and machine Z a five year life. The cost to purchase each machine is $1,750,000 and $1,478,000 for Y and Z, respectively. Use the same discount rate, 11%, that was used in the previous capital project analysis problem. Calculate the EAC for each and recommend which machine is most favorable from a cost standpoint. Discount rate 11.0% Machine Y Machine Z S 155,000 $ 88,000 67,000 $ 183,000 74,000 109,000 $ After-tax operating cost Depreciation tax sheild benefit Operating cash flow Economic life-years PV of operating cash flow (=PV) Cost of equipment PV of costs EAC (use =PMT)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts