Question: Service Pro Corp. (SPC) is preparing adjustments for its September 30 year-end. For the following transactions and events, show the September 30 adjusting entries SPC

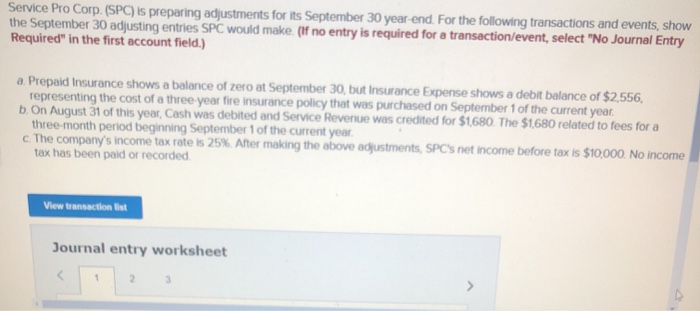

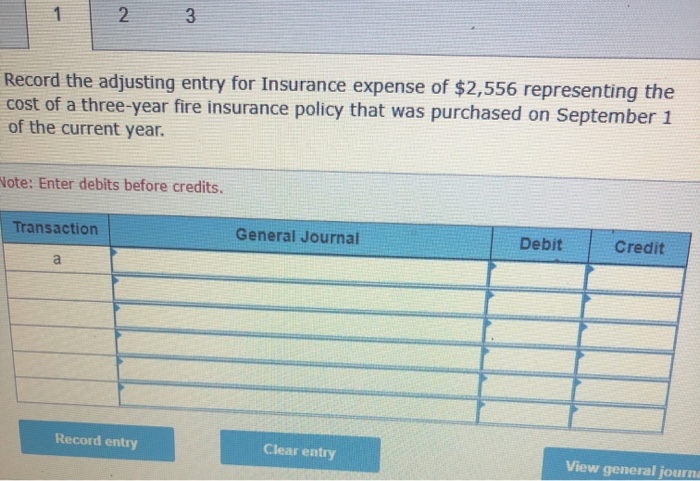

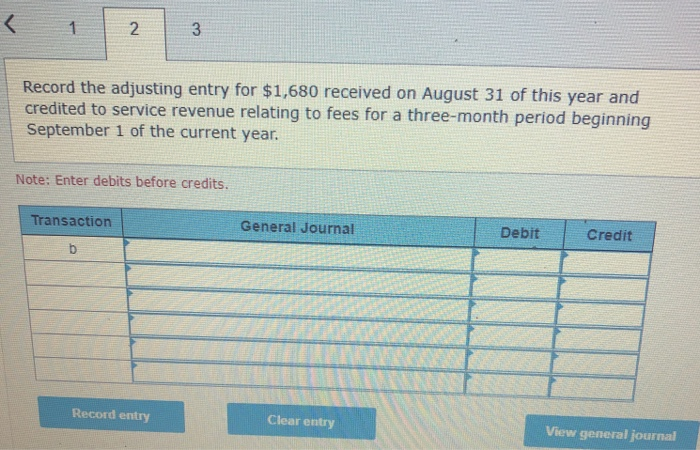

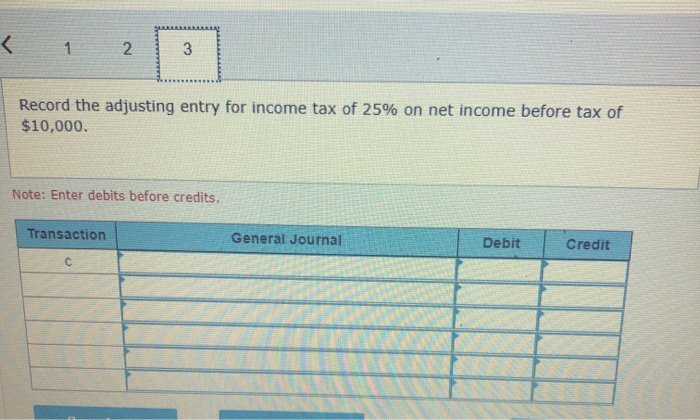

Service Pro Corp. (SPC) is preparing adjustments for its September 30 year-end. For the following transactions and events, show the September 30 adjusting entries SPC would make. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) a. Prepaid Insurance shows a balance of zero at September 30, but insurance Expense shows a debit balance of $2,556, representing the cost of a three-year fire insurance policy that was purchased on September 1 of the current year. b. On August 31 of this year, Cash was debited and Service Revenue was credited for $1680. The $1680 related to fees for a three-month period beginning September of the current year c. The company's income tax rate is 25% After making the above adjustments, SPC's net income before tax is $10,000. No income tax has been paid or recorded View transaction list Journal entry worksheet Record the adjusting entry for Insurance expense of $2,556 representing the cost of a three-year fire insurance policy that was purchased on September 1 of the current year. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journa Record the adjusting entry for $1,680 received on August 31 of this year and credited to service revenue relating to fees for a three-month period beginning September 1 of the current year. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Record the adjusting entry for income tax of 25% on net income before tax of $10,000. Note: Enter debits before credits. Transaction General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts