Question: services are provided to you under the Microsoft Services Agreement. F114 B D E F G H 52 9 53 54 55 56 57 58

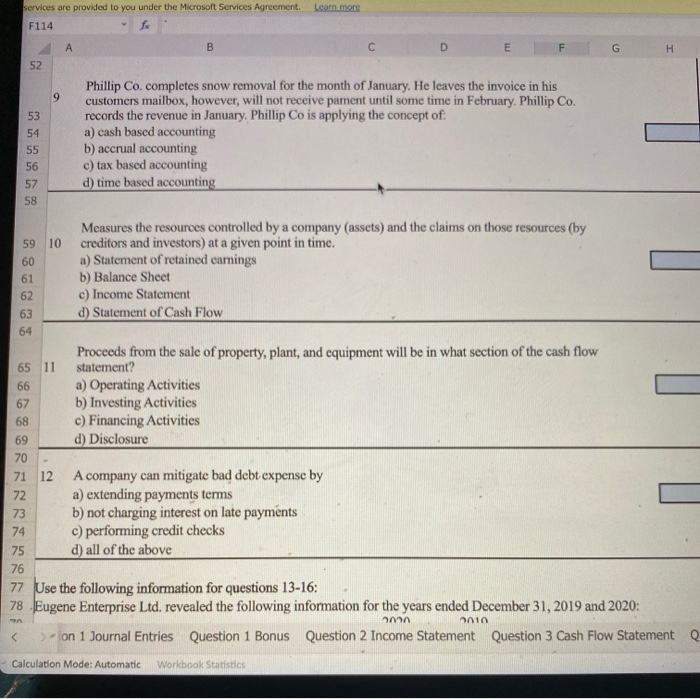

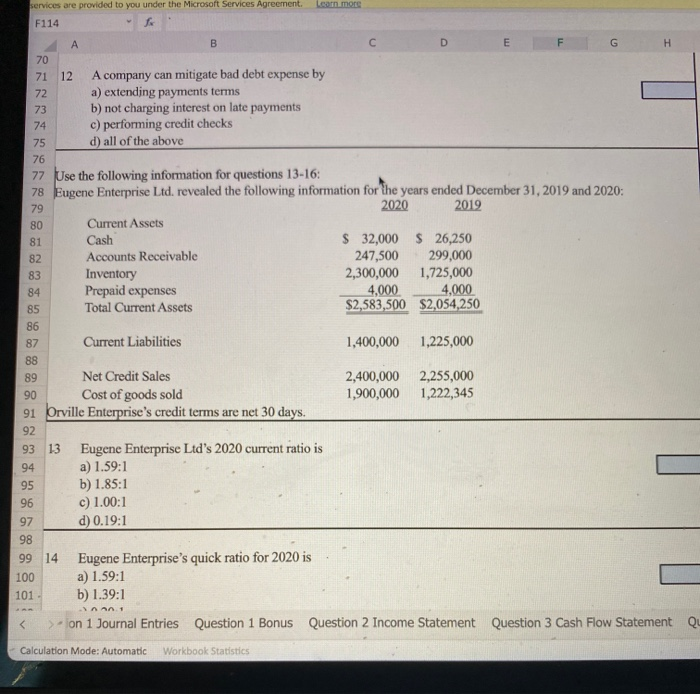

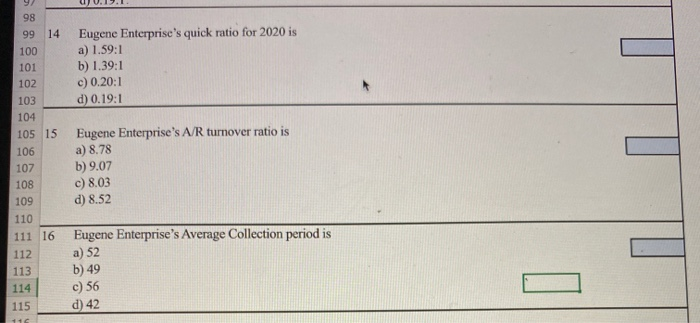

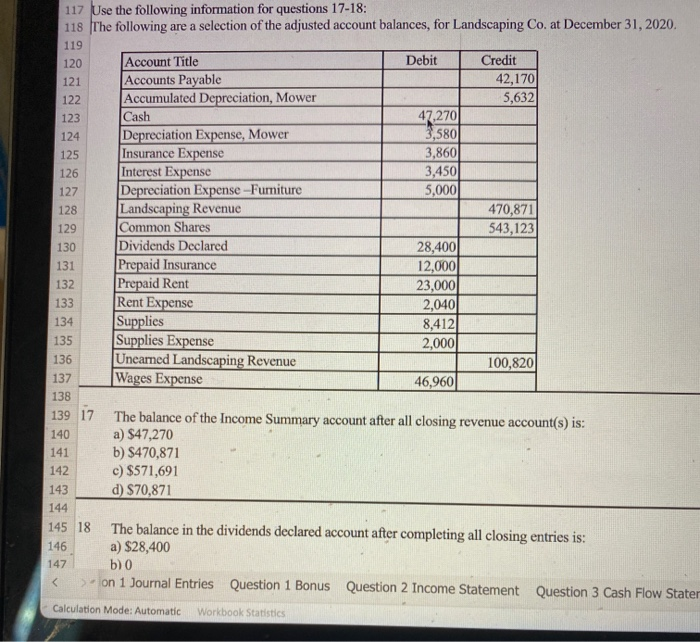

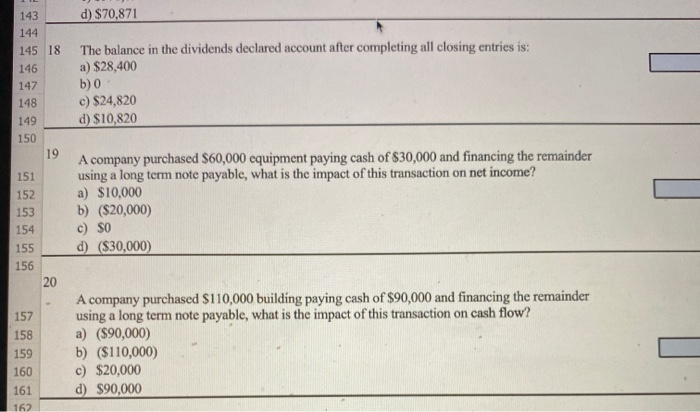

services are provided to you under the Microsoft Services Agreement. F114 B D E F G H 52 9 53 54 55 56 57 58 Phillip Co. completes snow removal for the month of January. He leaves the invoice in his customers mailbox, however, will not receive pament until some time in February. Phillip Co. records the revenue in January. Phillip Co is applying the concept of a) cash based accounting b) accrual accounting c) tax based accounting d) time based accounting 59 10 60 61 62 Measures the resources controlled by a company (assetsand the claims on those resources (by creditors and investors) at a given point in time. a) Statement of retained earnings b) Balance Sheet c) Income Statement d) Statement of Cash Flow 64 Proceeds from the sale of property, plant, and equipment will be in what section of the cash flow 65 11 statement? 66 a) Operating Activities 67 b) Investing Activities 68 c) Financing Activities 69 d) Disclosure 70 71 12 A company can mitigate bad debt expense by 72 a) extending payments terms 73 b) not charging interest on late payments 74 c) performing credit checks 75 d) all of the above 76 77 Use the following information for questions 13-16: 78 Eugene Enterprise Ltd. revealed the following information for the years ended December 31, 2019 and 2020: son 1 Journal Entries Question 1 Bonus Question 2 Income Statement Question 3 Cash Flow Statement Q ann 10 on 1 Journal Entries Question 1 Bonus Question 2 Income Statement Question 3 Cash Flow Stater Calculation Mode: Automatic Workbook Statistics d) $70,871 143 144 145 18 146 147 148 149 150 19 The balance in the dividends declared account after completing all closing entries is: a) $28,400 b) 0 c) $24,820 d) $10,820 151 152 153 154 155 156 20 A company purchased $60,000 equipment paying cash of $30,000 and financing the remainder using a long term note payable, what is the impact of this transaction on net income? a) $10,000 b) ($20,000) c) SO d) ($30,000) 157 158 159 160 161 A company purchased $110,000 building paying cash of $90,000 and financing the remainder using a long term note payable, what is the impact of this transaction on cash flow? a) ($90,000) b) ($110,000) c) $20,000 d) $90,000 162

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts