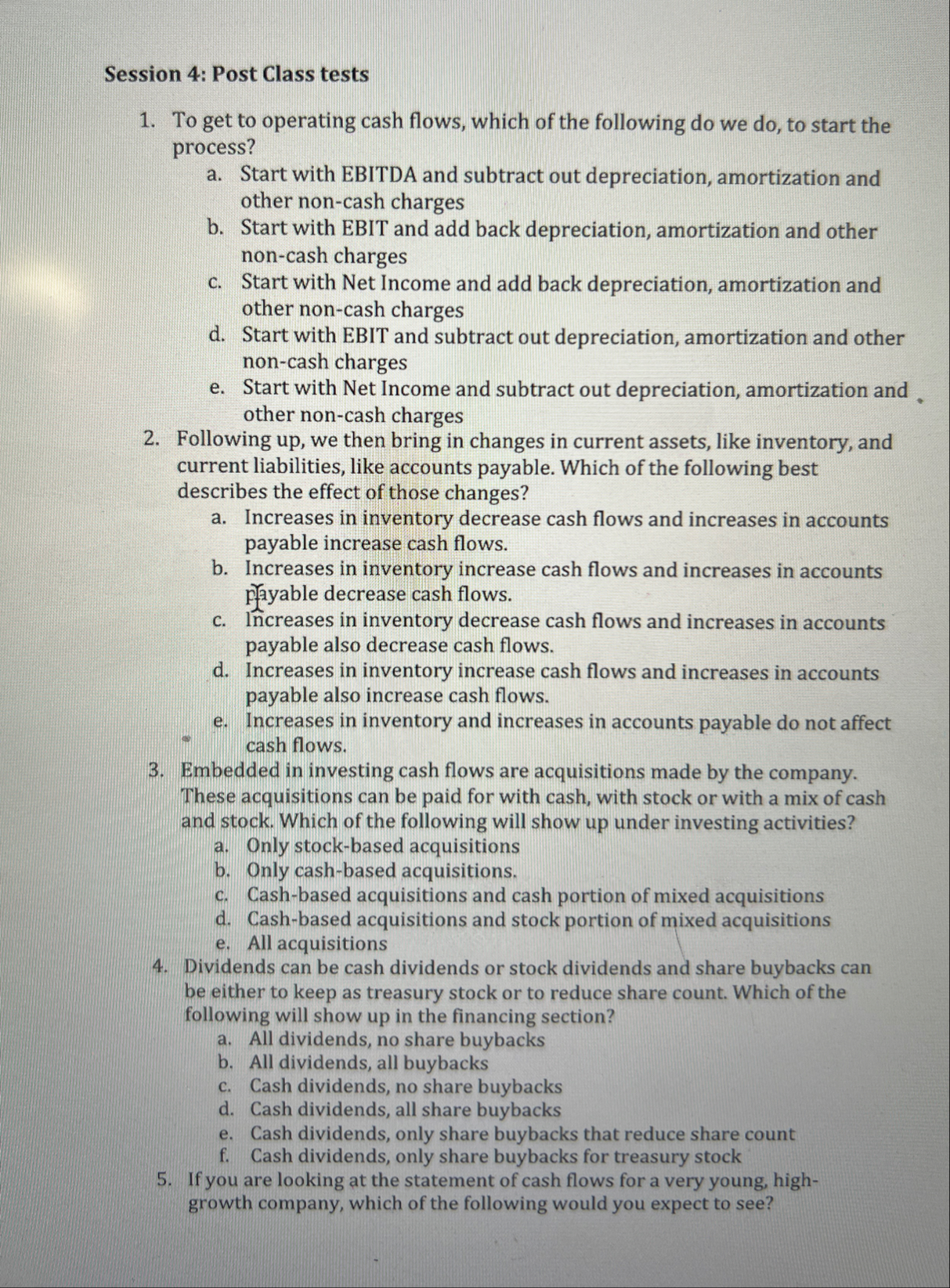

Question: Session 4 : Post Class tests To get to operating cash flows, which of the following do we do , to start the process? a

Session : Post Class tests

To get to operating cash flows, which of the following do we do to start the process?

a Start with EBITDA and subtract out depreciation, amortization and other noncash charges

b Start with EBIT and add back depreciation, amortization and other noncash charges

c Start with Net Income and add back depreciation, amortization and other noncash charges

d Start with EBIT and subtract out depreciation, amortization and other noncash charges

e Start with Net Income and subtract out depreciation, amortization and other noncash charges

Following up we then bring in changes in current assets, like inventory, and current liabilities, like accounts payable. Which of the following best describes the effect of those changes?

a Increases in inventory decrease cash flows and increases in accounts payable increase cash flows.

b Increases in inventory increase cash flows and increases in accounts fayable decrease cash flows.

c Increases in inventory decrease cash flows and increases in accounts payable also decrease cash flows.

d Increases in inventory increase cash flows and increases in accounts payable also increase cash flows.

e Increases in inventory and increases in accounts payable do not affect cash flows.

Embedded in investing cash flows are acquisitions made by the company. These acquisitions can be paid for with cash, with stock or with a mix of cash and stock. Which of the following will show up under investing activities?

a Only stockbased acquisitions

b Only cashbased acquisitions.

c Cashbased acquisitions and cash portion of mixed acquisitions

d Cashbased acquisitions and stock portion of mixed acquisitions

e All acquisitions

Dividends can be cash dividends or stock dividends and share buybacks can be either to keep as treasury stock or to reduce share count. Which of the following will show up in the financing section?

a All dividends, no share buybacks

b All dividends, all buybacks

c Cash dividends, no share buybacks

d Cash dividends, all share buybacks

e Cash dividends, only share buybacks that reduce share count

f Cash dividends, only share buybacks for treasury stock

If you are looking at the statement of cash flows for a very young, highgrowth company, which of the following would you expect to see?

a Positive cash flow from operations, Negative cash flow from investing and Negative cash flow from financing

b Negative cash flow from operations, Negative cash flow from investing and Positive cash flow from financing

c Negative cash flow from operations, Positive cash flow from investing and Negative cash flow from financing

d Negative cash flow from operations, Negative cash flow from investing and Negative cash flow from financing

e Positive cash flow from operations, Positive cash flow from investing and Positive cash flow from financing

Session A: Post Class tests

Cash Flow Statements of companies: manufacturing, retail & technology

For each of the three companies, estimate the effect that changes in noncash working capital are having or taking away on operating cash flows. What are the implications?

Under operating cash flows, each company is adding back stockbased compensation. What is the rationale for doing so

a Stock based compensation is not an expense

b Stock based compensation is not an accounting expense, but it is a cash expense

c Stock based compensation is an accounting expense, but it is not a cash expense

d Stock based compensation is a financing cash flow, not an operating cash flow

e None of the above

For each of the three companies, estimate how much of the investing cash flow represents investment in operating assets and how much in nonoperating assets. Why do we care?

For each of the three companies, estimate how much total debt changed during the course of the year, based upon the financing cash flows.

For each of the three companies, estimate how much was returned to stockholders in dividends and how much in net stock buybacks. What are the implications?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock