Question: sessment/revit 7. Process the quick entries the 5 quick entries from the A/R Receipt entry(15 marks) 8. February 5, 2019. Lang's machinery was awarded the

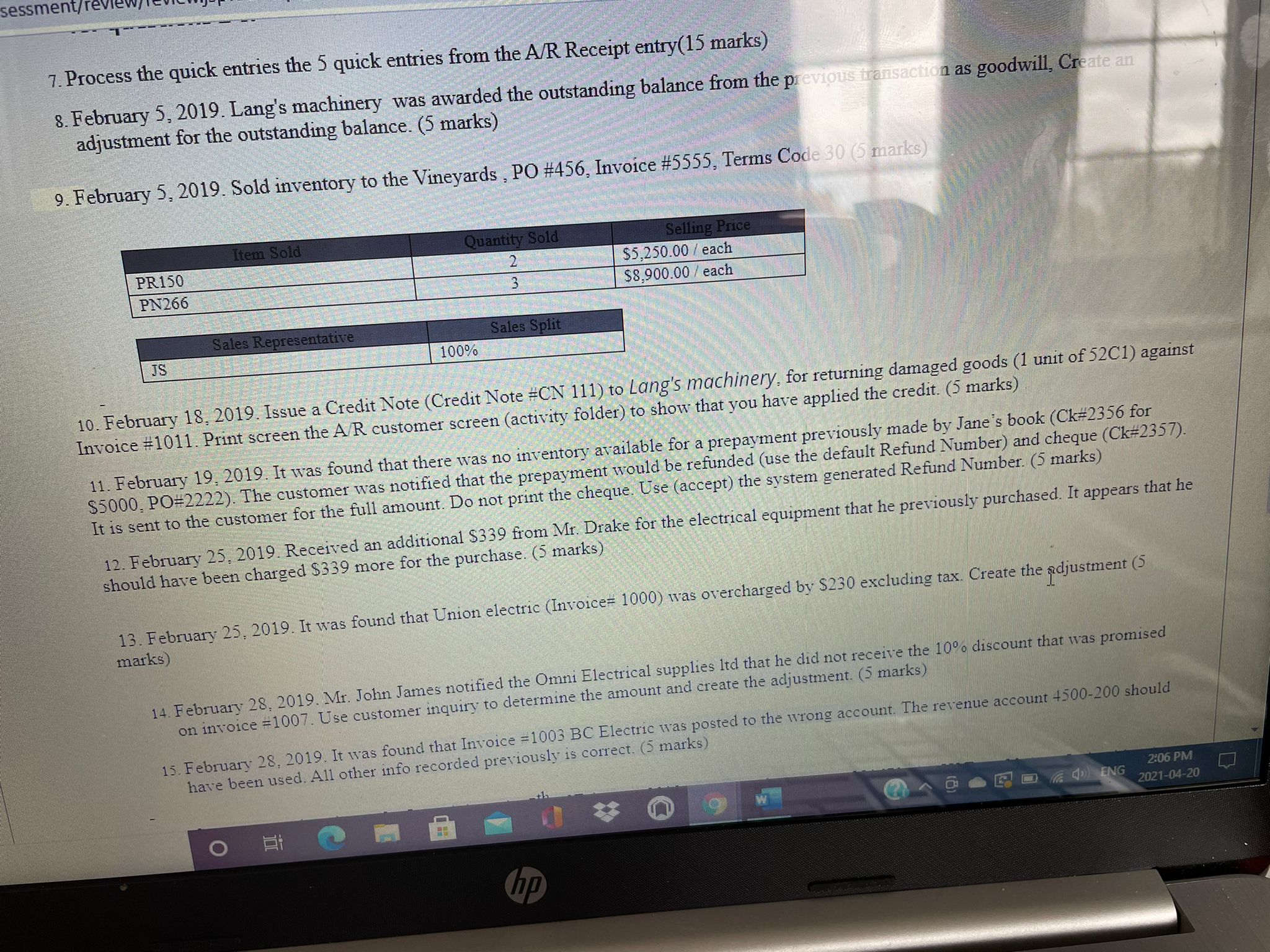

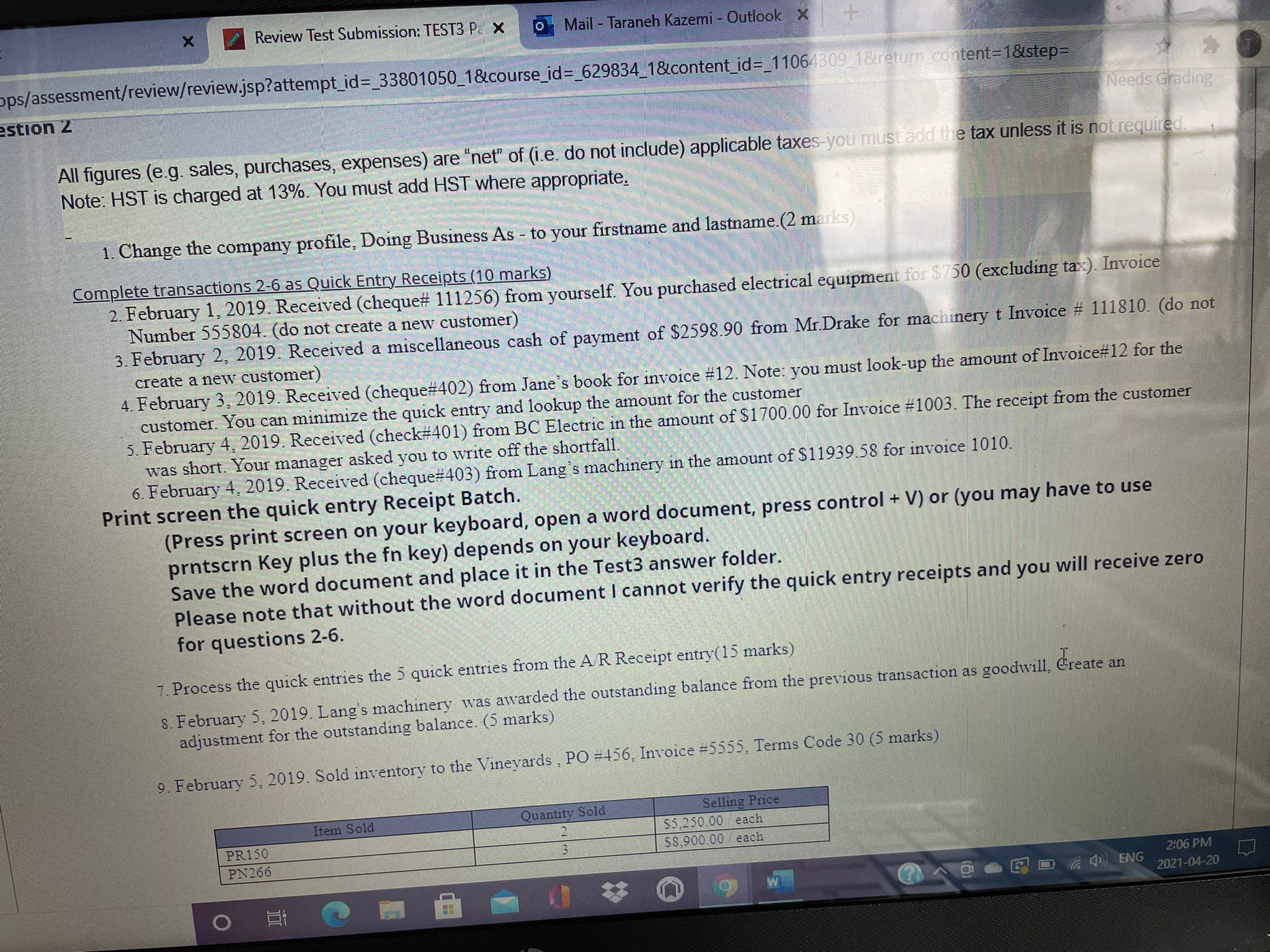

sessment/revit 7. Process the quick entries the 5 quick entries from the A/R Receipt entry(15 marks) 8. February 5, 2019. Lang's machinery was awarded the outstanding balance from the previous transaction as goodwill, Create an adjustment for the outstanding balance. (5 marks) 9. February 5, 2019. Sold inventory to the Vineyards , PO #456, Invoice #5555, Terms Code 30 (5 marks) Quantity Sold elling Price PR150 2 $5,250.00 / each PN266 3 $8,900.00 / each Sales Representative Sales Split JS 100% 10. February 18, 2019. Issue a Credit Note (Credit Note #CN 111) to Lang's machinery. for returning damaged goods (1 unit of 52C1) against Invoice #1011. Print screen the A/R customer screen (activity folder) to show that you have applied the credit. (5 marks) 11. February 19. 2019. It was found that there was no inventory available for a prepayment previously made by Jane's book (Ck#2356 for $5000. PO#2222). The customer was notified that the prepayment would be refunded (use the default Refund Number) and cheque (Ck#2357). It is sent to the customer for the full amount. Do not print the cheque. Use (accept) the system generated Refund Number. (5 marks) 12. February 25, 2019. Received an additional $339 from Mr. Drake for the electrical equipment that he previously purchased. It appears that he should have been charged $339 more for the purchase. (5 marks) 13. February 25, 2019. It was found that Union electric (Invoice# 1000) was overcharged by $230 excluding tax. Create the adjustment (5 marks) 14. February 28, 2019. Mr. John James notified the Omni Electrical supplies Itd that he did not receive the 10% discount that was promised on invoice #1007. Use customer inquiry to determine the amount and create the adjustment. (5 marks) 15. February 28, 2019. It was found that Invoice #1003 BC Electric was posted to the wrong account. The revenue account 4500-200 should have been used. All other info recorded previously is correct. (5 marks) 2:06 PM W 9 650 64 ENG 2021-04-20 O hpX Review Test Submission: TEST3 P. x To Mail - Taraneh Kazemi - Outlook x ps/assessment/review/review.jsp?attempt_id=_33801050_1&course_id=_629834_1&content_id=_11064309_1&return_content=1&step= estion 2 Needs Grading All figures (e.g. sales, purchases, expenses) are "net" of (i.e. do not include) applicable taxes-you must add the tax unless it is not required Note: HST is charged at 13%. You must add HST where appropriate. 1. Change the company profile, Doing Business As - to your firstname and lastname.(2 marks) Complete transactions 2-6 as Quick Entry Receipts (10 marks) 2. February 1, 2019. Received (cheque# 111256) from yourself. You purchased electrical equipment for $750 (excluding tax). Invoice Number 555804. (do not create a new customer) 3. February 2, 2019. Received a miscellaneous cash of payment of $2598.90 from Mr.Drake for machinery t Invoice # 111810. (do not create a new customer) 4. February 3, 2019. Received (cheque#402) from Jane's book for invoice #12. Note: you must look-up the amount of Invoice#12 for the customer. You can minimize the quick entry and lookup the amount for the customer 5. February 4. 2019. Received (check#401) from BC Electric in the amount of $1700.00 for Invoice #1003. The receipt from the customer was short. Your manager asked you to write off the shortfall. 6. February 4. 2019. Received (cheque#403) from Lang's machinery in the amount of $11939.58 for invoice 1010. Print screen the quick entry Receipt Batch. (Press print screen on your keyboard, open a word document, press control + V) or (you may have to use prntscrn Key plus the fn key) depends on your keyboard. Save the word document and place it in the Test3 answer folder. Please note that without the word document I cannot verify the quick entry receipts and you will receive zero for questions 2-6. 7. Process the quick entries the 5 quick entries from the A/R Receipt entry(15 marks) 8. February 5, 2019. Lang's machinery was awarded the outstanding balance from the previous transaction as goodwill, Create an adjustment for the outstanding balance. (5 marks) 9. February 5, 2019. Sold inventory to the Vineyards , PO #456, Invoice =5355, Terms Code 30 (5 marks) Item Sold Quantity Sold Selling Price PR150 $5,250.00 each PN266 58,900.00 / each 2:06 PM W 2) 40 65 0 14 ENG O Om 2021-04-20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts