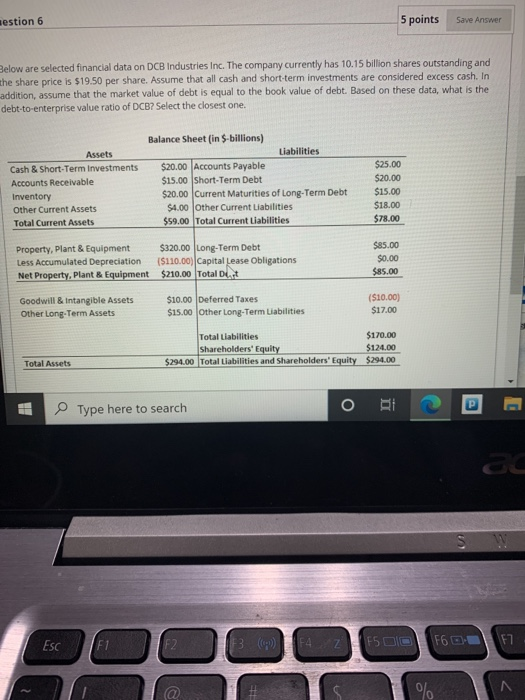

Question: sestion 6 5 points Save Answer Below are selected financial data on DCB Industries Inc. The company currently has 10.15 billion shares outstanding and the

sestion 6 5 points Save Answer Below are selected financial data on DCB Industries Inc. The company currently has 10.15 billion shares outstanding and the share price is $19.50 per share. Assume that all cash and short-term investments are considered excess cash. In addition, assume that the market value of debt is equal to the book value of debt. Based on these data, what is the debt-to-enterprise value ratio of DCB? Select the closest one. Assets Cash & Short-Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Balance Sheet (in S-billions) Liabilities $20.00 Accounts Payable $15.00 Short-Term Debt $20.00 Current Maturities of Long-Term Debt $4.00 Other Current Liabilities $59.00 Total Current Liabilities $25.00 $20.00 $15.00 $18.00 $78.00 Property, Plant & Equipment $320.00 Long-Term Debt Less Accumulated Depreciation ($110.00) Capital Lease Obligations Net Property, Plant & Equipment $210.00 Total Dict $85.00 $0.00 $85.00 Goodwill & Intangible Assets Other Long-Term Assets $10.00 Deferred Taxes $15.00 Other Long-Term Liabilities ($10.00) $17.00 Total Liabilities $170.00 Shareholders' Equity $124.00 $294.00 Total Liabilities and Shareholders' Equity $294.00 Total Assets Type here to search O BI P ac Esc F2 13 (542 F5 DIO F7 F60 @ % 1 Other Long-Term Assets $15.00 Other Long-Term Liabilities Total Liabilities Shareholders' Equity $294.00 Total Liabilities and Shareholders' Equity Total Assets Ol. 60.96% II. 33.5796 III.79.32% O IV. 39.65% OV. 44.35% Moving to another question will save this response. Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts