Question: Setup for Part A through Part F. Larry is single, lives in Wisconsin, is forty-five years old, has $0 in Traditional IRAs, and has $0

Setup for Part A through Part F. Larry is single, lives in Wisconsin, is forty-five years old, has $0 in Traditional IRAs, and has $0 in Roth IRAs. Larry and his brother John bought forty acres of hunting ground in 2010 and they own it as joint tenants with right of survivorship. Larry works at Titan Bank and recently received a big promotion & raise so he is no longer eligible to make contributions to a Roth IRA. However, Titan Bank offers a 401(k) where Titan will match 50 cents on the dollar up to 6% of the employee's pay. Larry plans to max out his 401(k) with 50% of his contributions going into the 401(k) and 50% going into the Roth 401(k). When Larry completed the legal paperwork for the Titan Bank 401(k) account, he does not name any beneficiaries. Larry has $80,000 of pre-tax dollars in a Fidelity 403(b) account from a former employer and he did not name any beneficiaries. The $80,000 is in a Fidelity 2040 target date fund which has a 0.52% annual expense ratio. Larry writes a legal will which states his very close friend, Joseph, will inherit all of Larrys assets including all his retirement accounts.

I ONLY NEED PART C OF QUESTION 2 ANSWERED. THANK YOU

I ONLY NEED PART C OF QUESTION 2 ANSWERED. THANK YOU

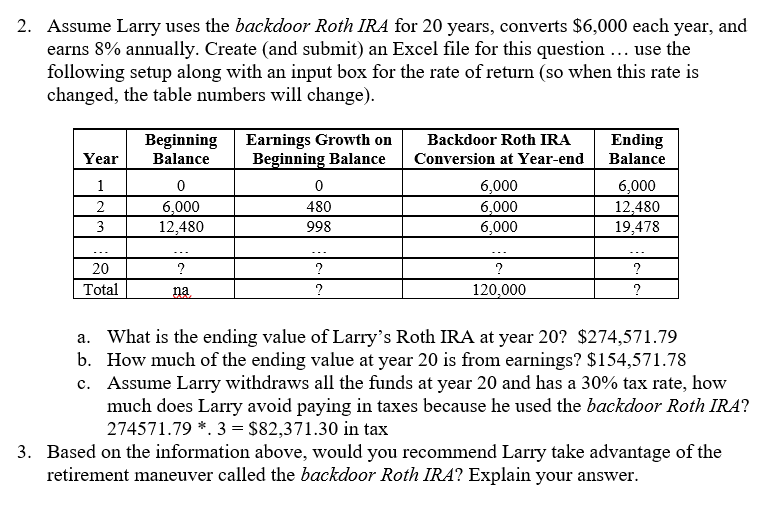

2. Assume Larry uses the backdoor Roth IRA for 20 years, converts $6,000 each year, and earns 8% annually. Create and submit) an Excel file for this question ... use the following setup along with an input box for the rate of return (so when this rate is changed, the table numbers will change). Year 1 2 3 Beginning Balance 0 6,000 12,480 Earnings Growth on Beginning Balance 0 480 998 Backdoor Roth IRA Conversion at Year-end 6,000 6,000 6,000 Ending Balance 6,000 12,480 19,478 ? 20 Total ? ? ? 120,000 ? ? na a. What is the ending value of Larry's Roth IRA at year 20? $274,571.79 b. How much of the ending value at year 20 is from earnings? $154,571.78 c. Assume Larry withdraws all the funds at year 20 and has a 30% tax rate, how much does Larry avoid paying in taxes because he used the backdoor Roth IRA? 274571.79*. 3 = $82,371.30 in tax 3. Based on the information above, would you recommend Larry take advantage of the retirement maneuver called the backdoor Roth IRA? Explain your answer. 2. Assume Larry uses the backdoor Roth IRA for 20 years, converts $6,000 each year, and earns 8% annually. Create and submit) an Excel file for this question ... use the following setup along with an input box for the rate of return (so when this rate is changed, the table numbers will change). Year 1 2 3 Beginning Balance 0 6,000 12,480 Earnings Growth on Beginning Balance 0 480 998 Backdoor Roth IRA Conversion at Year-end 6,000 6,000 6,000 Ending Balance 6,000 12,480 19,478 ? 20 Total ? ? ? 120,000 ? ? na a. What is the ending value of Larry's Roth IRA at year 20? $274,571.79 b. How much of the ending value at year 20 is from earnings? $154,571.78 c. Assume Larry withdraws all the funds at year 20 and has a 30% tax rate, how much does Larry avoid paying in taxes because he used the backdoor Roth IRA? 274571.79*. 3 = $82,371.30 in tax 3. Based on the information above, would you recommend Larry take advantage of the retirement maneuver called the backdoor Roth IRA? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts