Question: SETUP QUESTION: You will use the following information for other questions below (for the numbers that are not updated in the questions that refer back

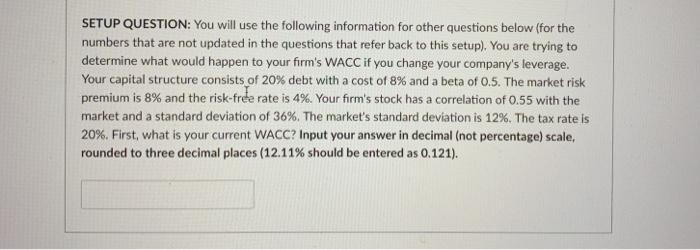

SETUP QUESTION: You will use the following information for other questions below (for the numbers that are not updated in the questions that refer back to this setup). You are trying to determine what would happen to your firm's WACC if you change your company's leverage. Your capital structure consists of 20% debt with a cost of 8% and a beta of 0.5. The market risk premium is 8% and the risk-free rate is 4%. Your firm's stock has a correlation of 0.55 with the market and a standard deviation of 36%. The market's standard deviation is 12%. The tax rate is 20%. First, what is your current WACC? Input your answer in decimal (not percentage) scale, rounded to three decimal places (12.11% should be entered as 0.121)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts