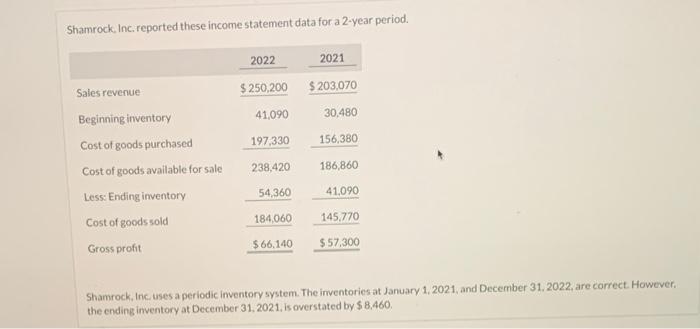

Question: Shamrock, Inc. reported these income statement data for a 2-year period. 2022 2021 $ 203.070 Sales revenue $ 250,200 41,090 30.480 197,330 156,380 238,420 186,860

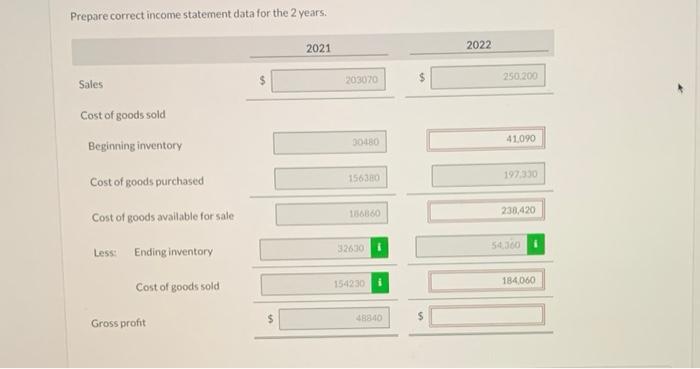

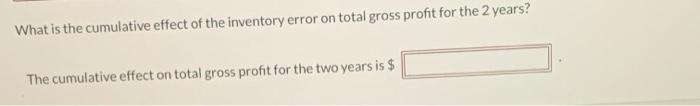

Shamrock, Inc. reported these income statement data for a 2-year period. 2022 2021 $ 203.070 Sales revenue $ 250,200 41,090 30.480 197,330 156,380 238,420 186,860 Beginning inventory Cost of goods purchased Cost of goods available for sale Less: Ending inventory Cost of goods sold Gross profit 54,360 41.090 184,060 145.770 $ 66,140 $57,300 a Shamrock, Inc. uses a periodic inventory system. The inventories at January 1, 2021, and December 31, 2022, are correct. However, the ending inventory at December 31, 2021, is overstated by $8,460, Prepare correct income statement data for the 2 years. 2021 2022 Sales 250.200 203070 Cost of goods sold 30180 41.090 Beginning inventory 15630 Cost of goods purchased 197.330 1360 238.420 Cost of goods available for sale Less Ending inventory 54100 32630 1 154230 184060 Cost of goods sold 4840 $ Gross profit What is the cumulative effect of the inventory error on total gross profit for the 2 years? The cumulative effect on total gross profit for the two years is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts