Question: Shamrock Oil ( see Problem 8 - 3 7 ) has decided to rely on utility theory to assist in the decision concerning the oil

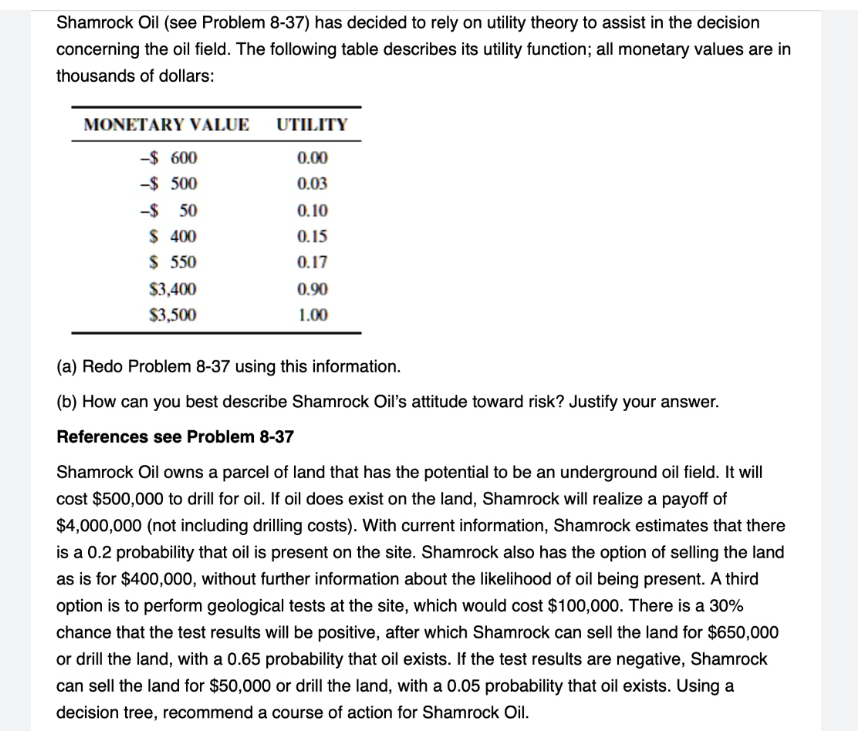

Shamrock Oil see Problem has decided to rely on utility theory to assist in the decision

concerning the oil field. The following table describes its utility function; all monetary values are in

thousands of dollars:

a Redo Problem using this information.

b How can you best describe Shamrock Oil's attitude toward risk? Justify your answer.

References see Problem

Shamrock Oil owns a parcel of land that has the potential to be an underground oil field. It will

cost $ to drill for oil. If oil does exist on the land, Shamrock will realize a payoff of

$not including drilling costs With current information, Shamrock estimates that there

is a probability that oil is present on the site. Shamrock also has the option of selling the land

as is for $ without further information about the likelinood of oil being present. A third

option is to perform geological tests at the site, which would cost $ There is a

chance that the test results will be positive, after which Shamrock can sell the land for $

or drill the land, with a probability that oil exists. If the test results are negative, Shamrock

can sell the land for $ or drill the land, with a probability that oil exists. Using a

decision tree, recommend a course of action for Shamrock Oil.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock