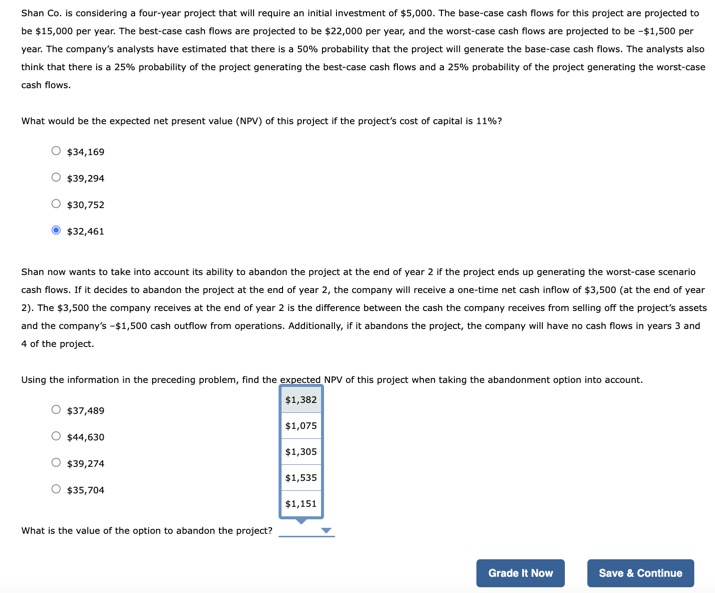

Question: Shan C o . i s considering a four - year project that will require a n initial investment o f $ 5 , 0

Shan considering a fouryear project that will require initial investment $ The basecase cash flows for this project are projected

$ per year. The bestcase cash flows are projected $ per year, and the worstcase cash flows are projected $ per

year. The company's analysts have estimated that there probability that the project will generate the basecase cash flows. The analysts also

think that there probability the project generating the bestcase cash flows and probability the project generating the worstcase

cash flows.

What would the expected net present value this project the project's cost capital

$

$

$

$

Shan now wants take into account its ability abandon the project the end year the project ends generating the worstcase scenario

cash flows. decides abandon the project the end year the company will recelve a onetime net cash inflow $$ the company receives the end year the difference between the cash the company receives from selling off the project's assets

and the company's $ cash outflow from operations. Additionally, abandons the project, the company will have cash flows years and

the project.

Using the information the preceding problem, find the expected this project when taking the abandonment option into account.

$

$

$

$

What the value the option abandon the project?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock