Question: Shane has never filed a tax return despite earning excessive sums of money as a gambler. When does the statute of limitations expire for the

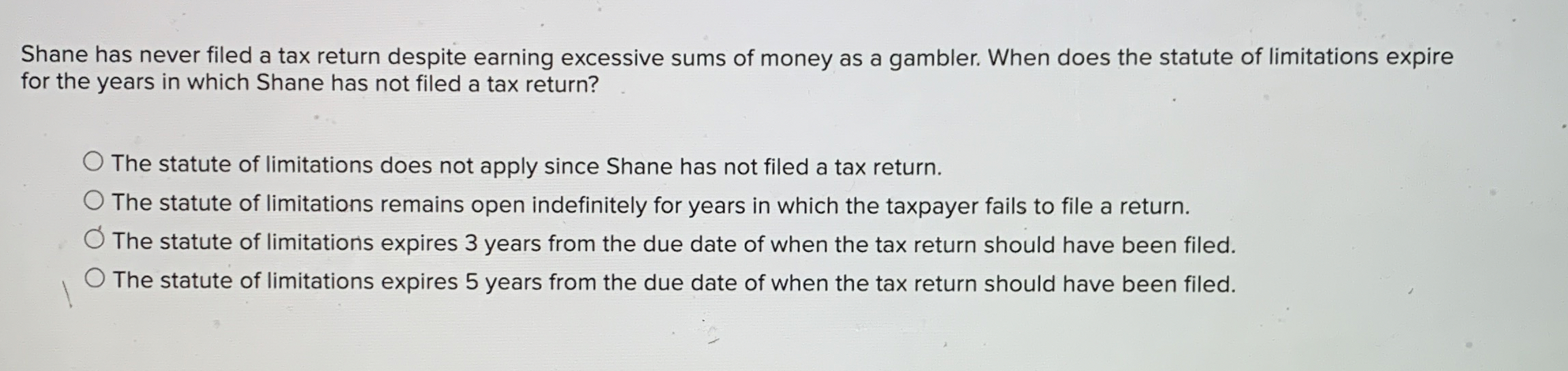

Shane has never filed a tax return despite earning excessive sums of money as a gambler. When does the statute of limitations expire for the years in which Shane has not filed a tax return?

The statute of limitations does not apply since Shane has not filed a tax return.

The statute of limitations remains open indefinitely for years in which the taxpayer fails to file a return.

The statute of limitations expires years from the due date of when the tax return should have been filed.

The statute of limitations expires years from the due date of when the tax return should have been filed.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock