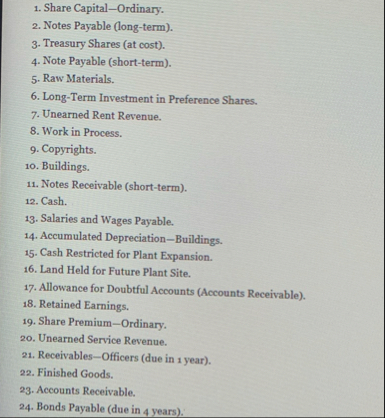

Question: Share Capital - Ordinary. Notes Payable ( long - term ) . Treasury Shares ( at cost ) . Note Payable ( short - term

Share CapitalOrdinary.

Notes Payable longterm

Treasury Shares at cost

Note Payable shortterm

Raw Materials.

LongTerm Investment in Preference Shares.

Unearned Rent Revenue.

Work in Process.

Copyrights.

Buildings.

Notes Receivable shortterm

Cash.

Salaries and Wages Payable.

Accumulated DepreciationBuildings.

Cash Restricted for Plant Expansion.

Land Held for Future Plant Site.

Allowance for Doubtful Accounts Accounts Receivable

Retained Earnings.

Share PremiumOrdinary.

Unearned Service Revenue.

ReceivablesOfficers due in year

Finished Goods.

Accounts Receivable.

Bonds Payable due in years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock