Question: share where u got information from and complete all for multiple likes. - Interpreting financial statement information with an emphasis on revenue, cash, inventory, long-term

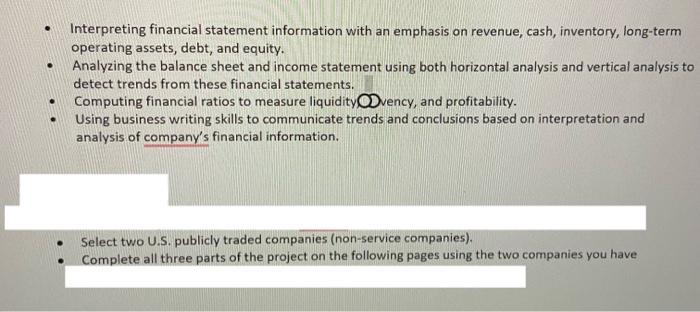

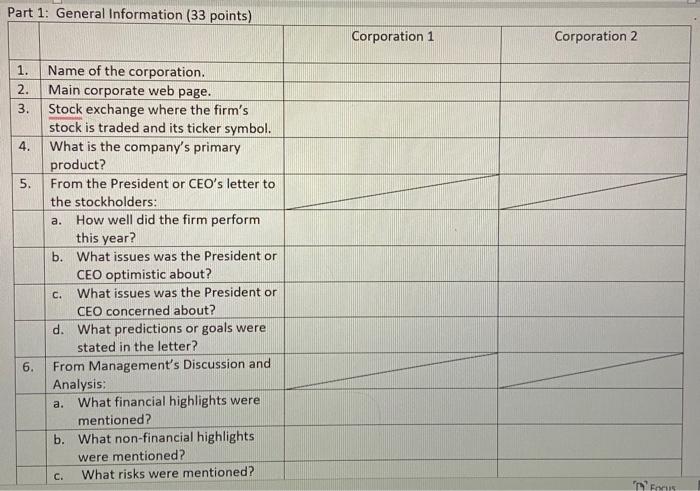

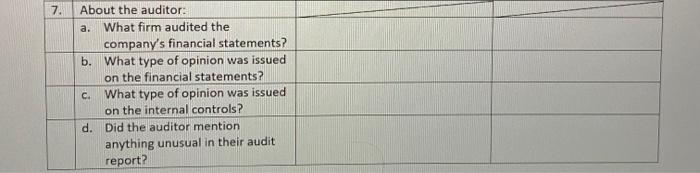

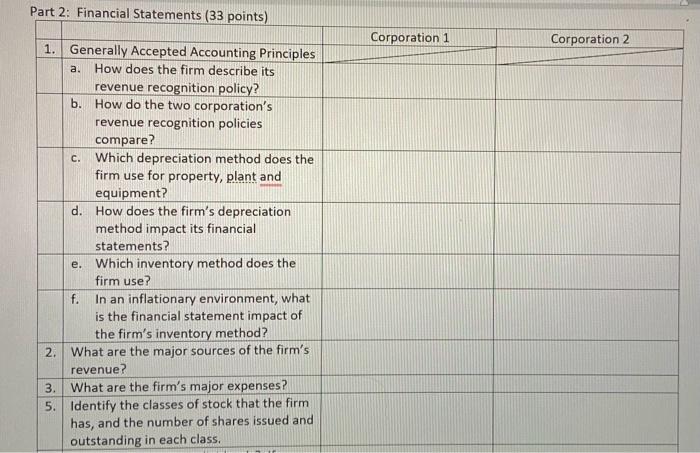

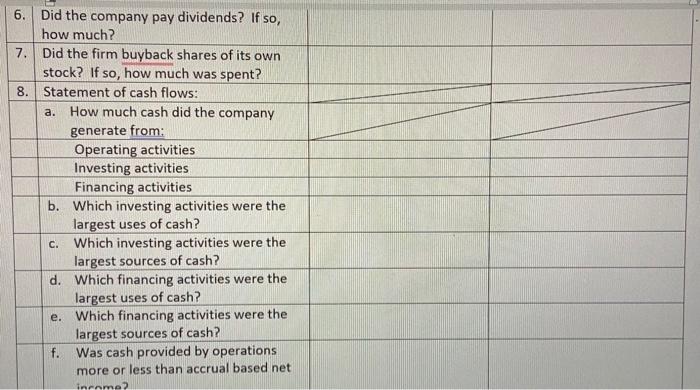

- Interpreting financial statement information with an emphasis on revenue, cash, inventory, long-term operating assets, debt, and equity. - Analyzing the balance sheet and income statement using both horizontal analysis and vertical analysis to detect trends from these financial statements. Computing financial ratios to measure liquidity Dvency, and profitability. Using business writing skills to communicate trends and conclusions based on interpretation and analysis of company's financial information. - Select two U.S. publicly traded companies (non-service companies). - Complete all three parts of the project on the following pages using the two companies you have Part 1: General Information ( 33 points) 7. About the auditor: a. What firm audited the company's financial statements? b. What type of opinion was issued on the financial statements? c. What type of opinion was issued on the internal controls? d. Did the auditor mention anything unusual in their audit report? Part 2: Financial Statements ( 33 points) 6. Did the company pay dividends? If so, how much? 7. Did the firm buyback shares of its own stock? If so, how much was spent? 8. Statement of cash flows: a. How much cash did the company generate from: Operating activities Investing activities Financing activities b. Which investing activities were the largest uses of cash? c. Which investing activities were the largest sources of cash? d. Which financing activities were the largest uses of cash? e. Which financing activities were the largest sources of cash? f. Was cash provided by operations more or less than accrual based net - Interpreting financial statement information with an emphasis on revenue, cash, inventory, long-term operating assets, debt, and equity. - Analyzing the balance sheet and income statement using both horizontal analysis and vertical analysis to detect trends from these financial statements. Computing financial ratios to measure liquidity Dvency, and profitability. Using business writing skills to communicate trends and conclusions based on interpretation and analysis of company's financial information. - Select two U.S. publicly traded companies (non-service companies). - Complete all three parts of the project on the following pages using the two companies you have Part 1: General Information ( 33 points) 7. About the auditor: a. What firm audited the company's financial statements? b. What type of opinion was issued on the financial statements? c. What type of opinion was issued on the internal controls? d. Did the auditor mention anything unusual in their audit report? Part 2: Financial Statements ( 33 points) 6. Did the company pay dividends? If so, how much? 7. Did the firm buyback shares of its own stock? If so, how much was spent? 8. Statement of cash flows: a. How much cash did the company generate from: Operating activities Investing activities Financing activities b. Which investing activities were the largest uses of cash? c. Which investing activities were the largest sources of cash? d. Which financing activities were the largest uses of cash? e. Which financing activities were the largest sources of cash? f. Was cash provided by operations more or less than accrual based net

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts