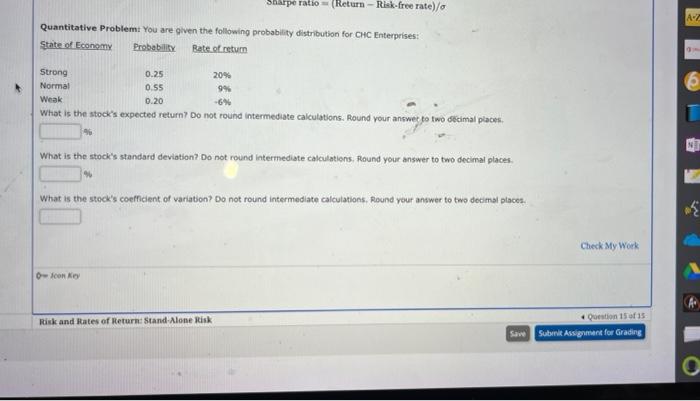

Question: Sharpe ratio (Return-Risk-free rate)/o Quantitative Problem: You are given the following probability distribution for CHC Enterprises: State of Economy Probability Bate of return Strong 9%

Sharpe ratio (Return-Risk-free rate)/o Quantitative Problem: You are given the following probability distribution for CHC Enterprises: State of Economy Probability Bate of return Strong 9% Normal Weak -6% What is the stock's expected return? Do not round intermediate calculations. Round your answer to two decimal places. 0.25 0.55 0.20 What is the stock's standard deviation? Do not round intermediate calculations. Round your answer to two decimal places. O-Joon Key 20% What is the stock's coefficient of variation? Do not round intermediate calculations. Round your answer to two decimal places. Risk and Rates of Return: Stand Alone Risk Save Check My Work Question 15 of 15 Submit Assignment for Grading A-Z 01 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts