Question: Shaw Landscapes (SL) develops and sells plans for various types of gardens and outdoor spaces. Customers use the plans to install various landscape features

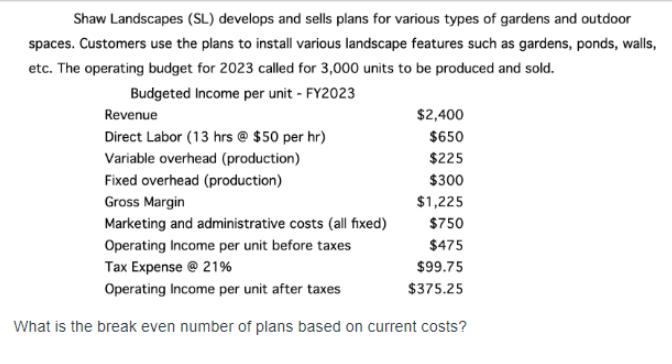

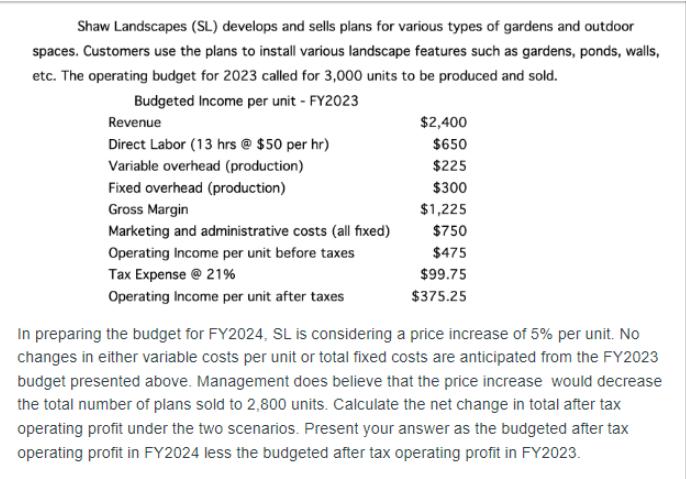

Shaw Landscapes (SL) develops and sells plans for various types of gardens and outdoor spaces. Customers use the plans to install various landscape features such as gardens, ponds, walls, etc. The operating budget for 2023 called for 3,000 units to be produced and sold. Budgeted Income per unit - FY2023 Revenue $2,400 Direct Labor (13 hrs @ $50 per hr) $650 Variable overhead (production) $225 Fixed overhead (production) $300 Gross Margin $1,225 Marketing and administrative costs (all fixed) $750 Operating Income per unit before taxes Tax Expense @ 21% Operating Income per unit after taxes $475 $99.75 $375.25 What is the break even number of plans based on current costs? Shaw Landscapes (SL) develops and sells plans for various types of gardens and outdoor spaces. Customers use the plans to install various landscape features such as gardens, ponds, walls, etc. The operating budget for 2023 called for 3,000 units to be produced and sold. Budgeted Income per unit - FY2023 Revenue $2,400 Direct Labor (13 hrs @ $50 per hr) $650 Variable overhead (production) $225 Fixed overhead (production) $300 Gross Margin $1,225 Marketing and administrative costs (all fixed) $750 Operating Income per unit before taxes $475 Tax Expense @ 21% Operating Income per unit after taxes $99.75 $375.25 In preparing the budget for FY2024, SL is considering a price increase of 5% per unit. No changes in either variable costs per unit or total fixed costs are anticipated from the FY2023 budget presented above. Management does believe that the price increase would decrease the total number of plans sold to 2,800 units. Calculate the net change in total after tax operating profit under the two scenarios. Present your answer as the budgeted after tax operating profit in FY2024 less the budgeted after tax operating profit in FY2023.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts