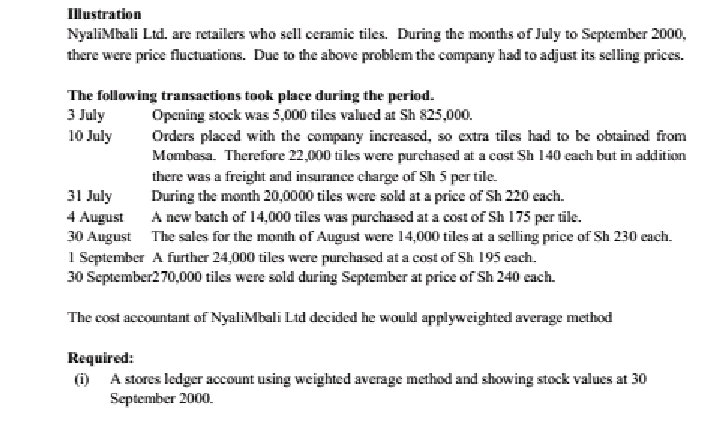

Question: Shd be typed...and well explained...please its a complete question helpp me Illustration NyaliMbali Lid. are retailers who sell ceramic tiles. During the months of July

Shd be typed...and well explained...please its a complete question helpp me

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock