Question: She also ascertained that the robust growth patterns displayed by Locomotive Public Ltd . over the past decade were anticipated to persist indefinitely due to

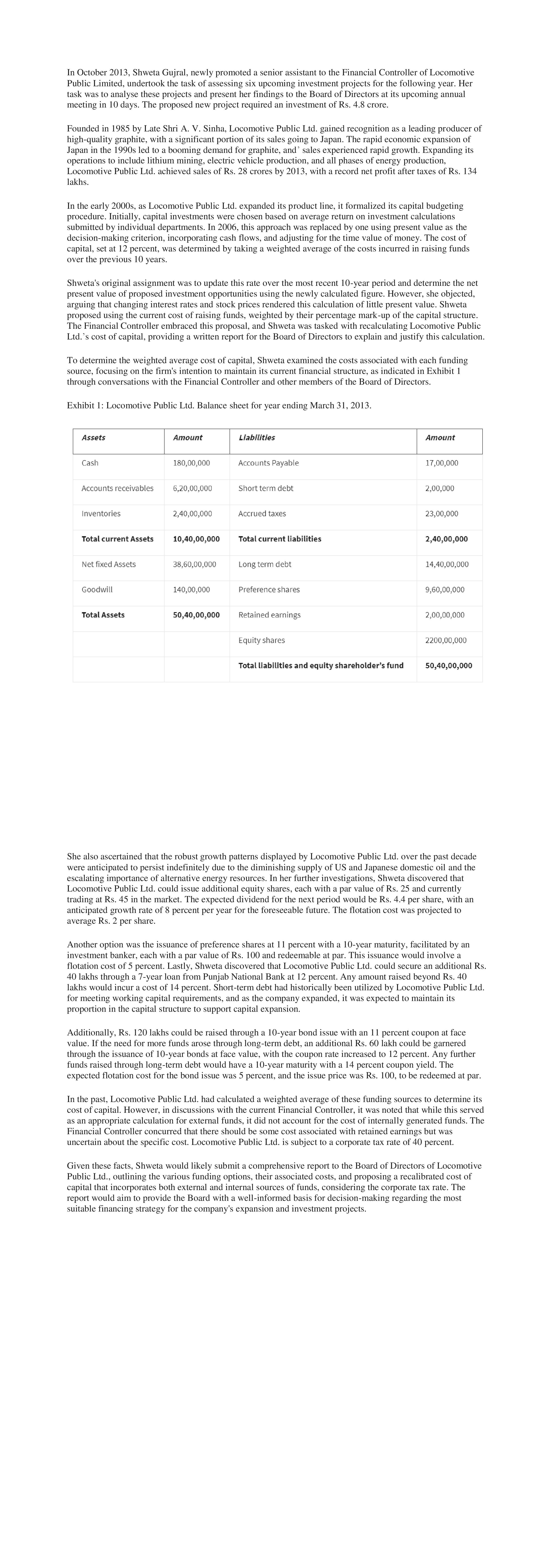

She also ascertained that the robust growth patterns displayed by Locomotive Public Ltd over the past decade were anticipated to persist indefinitely due to the diminishing supply of US and Japanese domestic oil and the escalating importance of alternative energy resources. In her further investigations, Shweta discovered that Locomotive Public Ltd could issue additional equity shares, each with a par value of Rs and currently trading at Rs in the market. The expected dividend for the next period would be Rs per share, with an anticipated growth rate of percent per year for the foreseeable future. The flotation cost was projected to average Rs per share.

Another option was the issuance of preference shares at percent with a year maturity, facilitated by an investment banker, each with a par value of Rs and redeemable at par. This issuance would involve a flotation cost of percent. Lastly, Shweta discovered that Locomotive Public Ltd could secure an additional Rs lakhs through a year loan from Punjab National Bank at percent. Any amount raised beyond Rs lakhs would incur a cost of percent. Shortterm debt had historically been utilized by Locomotive Public Ltd for meeting working capital requirements, and as the company expanded, it was expected to maintain its proportion in the capital structure to support capital expansion.

Additionally, Rs lakhs could be raised through a year bond issue with an percent coupon at face value. If the need for more funds arose through longterm debt, an additional Rs lakh could be garnered through the issuance of year bonds at face value, with the coupon rate increased to percent. Any further funds raised through longterm debt would have a year maturity with a percent coupon yield. The expected flotation cost for the bond issue was percent, and the issue price was Rs to be redeemed at par.

In the past, Locomotive Public Ltd had calculated a weighted average of these funding sources to determine its cost of capital. However, in discussions with the current Financial Controller, it was noted that while this served as an appropriate calculation for external funds, it did not account for the cost of internally generated funds. The Financial Controller concurred that there should be some cost associated with retained earnings but was uncertain about the specific cost. Locomotive Public Ltd is subject to a corporate tax rate of percent.

Given these facts, Shweta would likely submit a comprehensive report to the Board of Directors of Locomotive Public Ltd outlining the various funding options, their associated costs, and proposing a recalibrated cost of capital that incorporates both external and internal sources of funds, considering the corporate tax rate. The report would aim to provide the Board with a wellinformed basis for decisionmaking regarding the most suitable financing strategy for the company's expansion and investment projects.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock