Question: Sheep Ranch Golf Academy is evaluating new golf practice equipment. The Dimple - Max equipment costs $ 1 3 8 , 0 0 0 ,

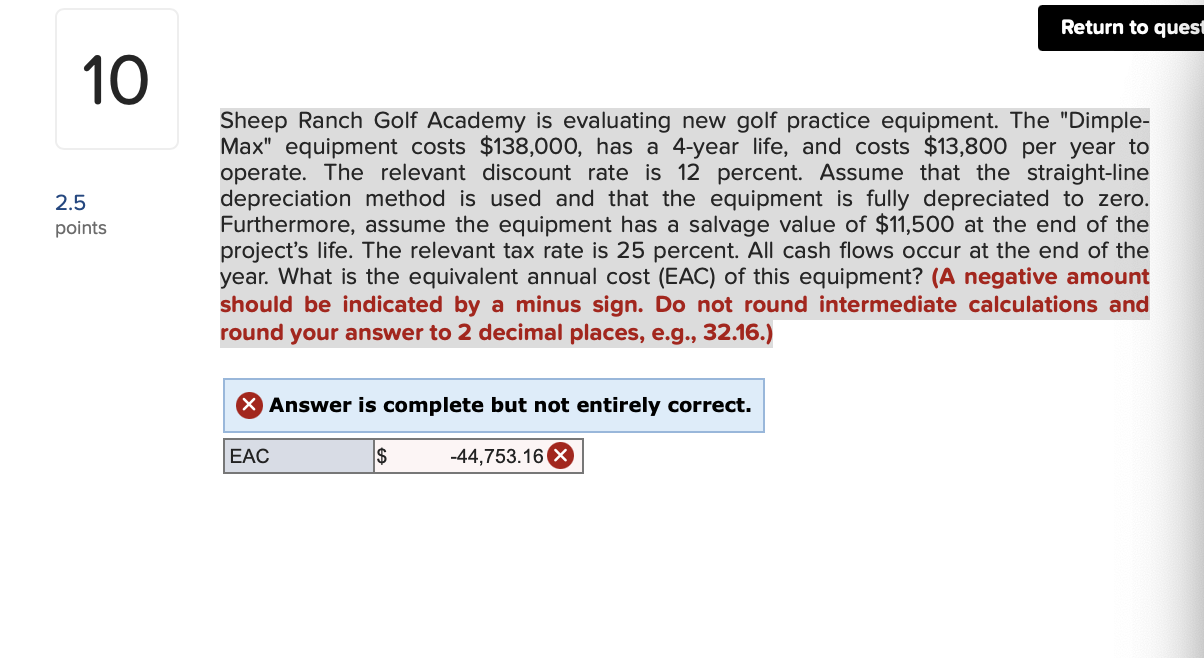

Sheep Ranch Golf Academy is evaluating new golf practice equipment. The "DimpleMax" equipment costs $ has a year life, and costs $ per year to operate. The relevant discount rate is percent. Assume that the straightline depreciation method is used and that the equipment is fully depreciated to zero. Furthermore, assume the equipment has a salvage value of $ at the end of the projects life. The relevant tax rate is percent. All cash flows occur at the end of the year. What is the equivalent annual cost EAC of this equipment? A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to decimal places, eg

Sheep Ranch Golf Academy is evaluating new golf practice equipment. The "DimpleMax" equipment costs $ has a year life, and costs $ per year to operate. The relevant discount rate is percent. Assume that the straightline

depreciation method is used and that the equipment is fully depreciated to zero. Furthermore, assume the equipment has a salvage value of $ at the end of the project's life. The relevant tax rate is percent. All cash flows occur at the end of the year. What is the equivalent annual cost EAC of this equipment? A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to decimal places, eg

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock