Question: 'Sheet 10'!C13 A B C D E F G You must type your name and ID number on the first sheet. H I 6 3

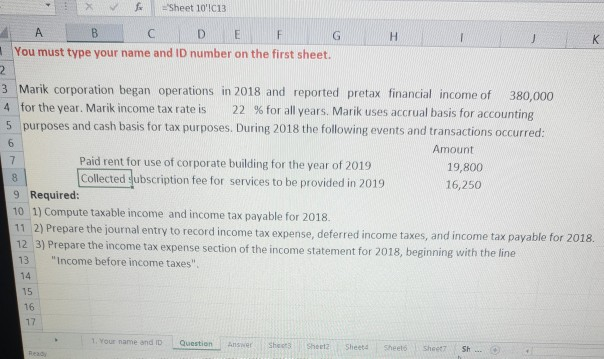

'Sheet 10'!C13 A B C D E F G You must type your name and ID number on the first sheet. H I 6 3 Marik corporation began operations in 2018 and reported pretax financial income of 380,000 4 for the year. Marikincome tax rate is 22 % for all years. Marik uses accrual basis for accounting 5 purposes and cash basis for tax purposes. During 2018 the following events and transactions occurred: Amount 7 Paid rent for use of corporate building for the year of 2019 19,800 Collected subscription fee for services to be provided in 2019 16,250 9 Required: 10 1) Compute taxable income and income tax payable for 2018 11 2) Prepare the journal entry to record income tax expense, deferred income taxes, and income tax payable for 2018. 12 3) Prepare the income tax expense section of the income statement for 2018, beginning with the line 13 "Income before income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts