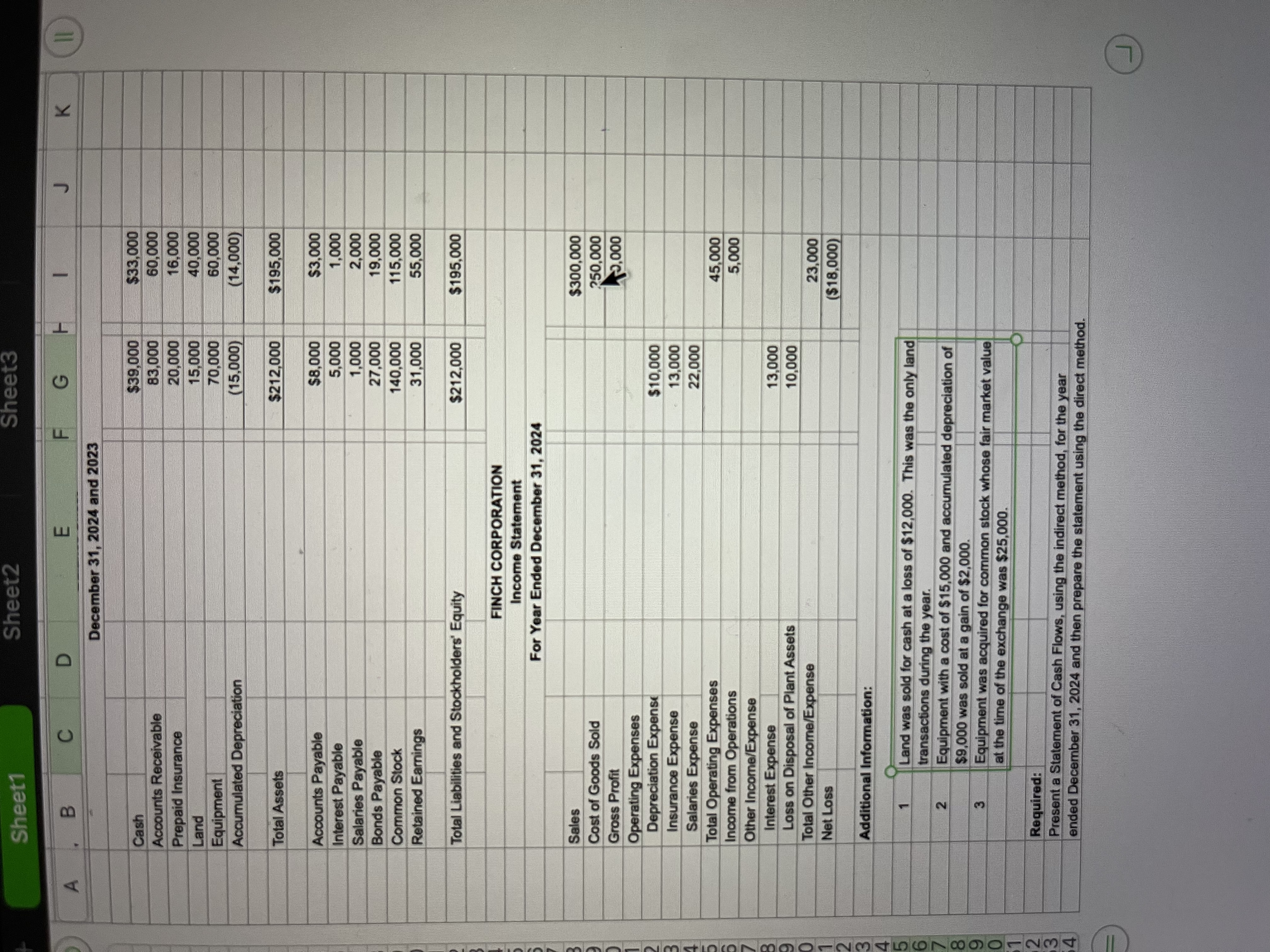

Question: Sheet1 Sheet2 Sheet3 A. B C D E F G December 31, 2024 and 2023 Cash Accounts Receivable Prepaid Insurance Land Equipment Accumulated Depreciation

Sheet1 Sheet2 Sheet3 A. B C D E F G December 31, 2024 and 2023 Cash Accounts Receivable Prepaid Insurance Land Equipment Accumulated Depreciation Total Assets Accounts Payable Interest Payable Salaries Payable $39,000 $33,000 83,000 60,000 20,000 16,000 15,000 40,000 70,000 60,000 (15,000) (14,000) $212,000 $195,000 $8,000 $3,000 5,000 1,000 1,000 2,000 Bonds Payable 27,000 19,000 Common Stock 140,000 115,000 Retained Earnings Total Liabilities and Stockholders' Equity 31,000 55,000 $212,000 $195,000 Sales 9 Cost of Goods Sold 3 1 3 1 234 Gross Profit Operating Expenses Depreciation Expense Insurance Expense Salaries Expense Total Operating Expenses FINCH CORPORATION Income Statement For Year Ended December 31, 2024 Income from Operations Other Income/Expense Interest Expense Loss on Disposal of Plant Assets Total Other Income/Expense Net Loss Additional Information: 1 $300,000 250,000 5,000 $10,000 13,000 22,000 45,000 5,000 13,000 10,000 23,000 ($18,000) Land was sold for cash at a loss of $12,000. This was the only land transactions during the year. 2 Equipment with a cost of $15,000 and accumulated depreciation of $9,000 was sold at a gain of $2,000. 3 Equipment was acquired for common stock whose fair market value at the time of the exchange was $25,000. Required: Present a Statement of Cash Flows, using the indirect method, for the year ended December 31, 2024 and then prepare the statement using the direct method. K L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts