Question: Sheffield Corp. leased an office under a five-year contract, which has been accounted for as an operating lease. Faced downturn in the economy, the viable

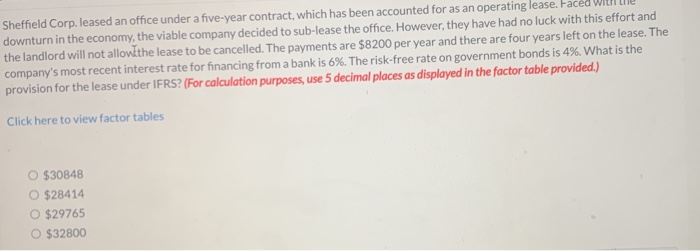

Sheffield Corp. leased an office under a five-year contract, which has been accounted for as an operating lease. Faced downturn in the economy, the viable company decided to sub-lease the office. However, they have had no luck with this effort and the landlord will not allow the lease to be cancelled. The payments are $8200 per year and there are four years left on the lease. The company's most recent interest rate for financing from a bank is 6%. The risk-free rate on government bonds is 4%. What is the provision for the lease under IFRS? (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Click here to view factor tables O $30848 O $28414 $29765 O $32800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts