Question: Sheldon Daly is district sales manager for a Vancouver-based distribution company. He has requested that you help him establish his employment income for tax purposes

Sheldon Daly is district sales manager for a Vancouver-based distribution company. He has requested that you help him establish his employment income for tax purposes for the 2023 taxation year. He has provided the following information for 2023:

- Sheldons base salary is $94,400. As sales manager, he is entitled to a small commission on the sales made by staff under his supervision. He received $8,700 in such commissions, which included $1,200 of commissions earned in late 2022. The December 2023 commissions were computed as $1,800 and were received in January 2024. The employer deducted the following from his salary in 2023:

| Canada Pension Plan contributions | $ | 3,754 |

| Employment Insurance premiums | 1,002 | |

| Private medical plan premiums | 300 |

- In addition to the above, the employer pays the following to Sheldon or on his behalf:

| Travel allowance | $ | 2,900 |

| Group term life insurance premiums for $50,000 coverage | 800 | |

| Premiums for a private medical insurance plan | 300 |

- Sheldons spouse died in late 2022, leaving him to support three children. In 2023, he hired a person at a cost of $9,000 to provide babysitting services for the two youngest children. Following his spouses death, Sheldon suffered from depression. As a result, his employer paid the cost of $3,000 for counselling services and also provided him with airline tickets costing $2,800 so that he and the children could visit a relaxation resort in 2023.

- Sheldon uses his own vehicle for employment duties. The vehicle (class 10.1) had an undepreciated capital cost of $17,000 at the end of 2022. Sheldon paid $4,800 in 2023 to operate the car and used it 60% of the time for employment duties.

- Sheldon incurred the following additional costs relating to his employment:

| Promotion (meals) | $ | 1,000 |

| Purchase of a cell phone | 500 | |

| Basic cell phone plan | 480 | |

| Lease costs for laptop computer | 700 | |

| Home internet | 800 | |

| Golf club dues | 1,000 | |

| Hotel costsout-of-town travel | 5,200 |

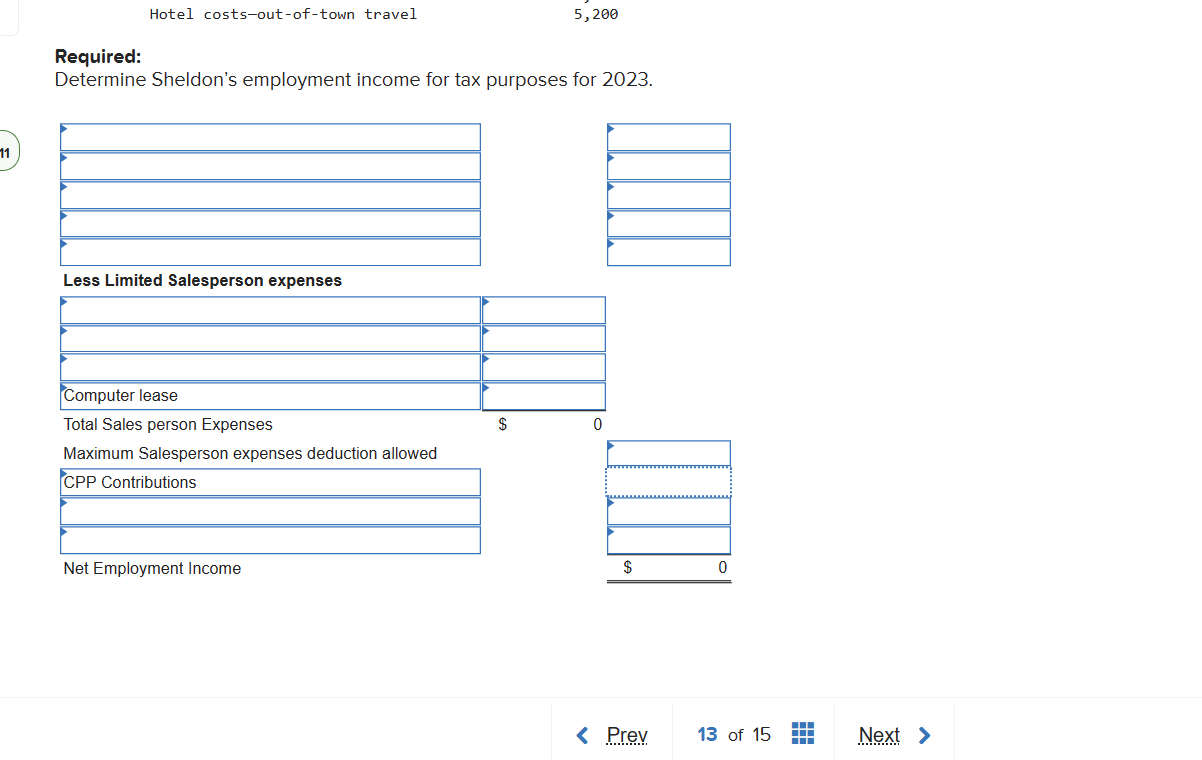

Required: Determine Sheldons employment income for tax purposes for 2023.

Required: Determine Sheldon's employment income for tax purposes for 2023

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock